Notes

(Note 1) The Task Force on Climate-related Financial Disclosures (TCFD): The TCFD recommends that companies disclose climate change-related risks and opportunities in its final report released in June 2017.

(Note 2) Green Transformation (GX): The transformation aimed at balancing both economic growth and environmental protection to achieve carbon neutrality and accelerate the transition to a decarbonized society.

(Note 3) A water risk identification and assessment tool provided by the World Resource Institute (WRI).

Assessment of Financial Impact from Climate Change Risks

Tokio Marine & Nichido Fire Insurance Co., Ltd.

| Publication date | September 9, 2024 (Posted on July 25, 2025) |

|---|---|

| Sector | Industrial and Economic Activities / Natural Disasters and Coastal Areas |

Company Overview

Tokio Marine & Nichido Fire Insurance Co., Ltd. is the core subsidiary of Tokio Marine Holdings in the domestic non-life insurance business.

Climate Change Impacts

Climate change is a global and historically unprecedented challenge that threatens the safety and security of both customers and society. The intensification of natural disasters has a significant impact on corporate management. Therefore, companies are expected to comprehensively assess the impact of future climate change on their business and disclose this information in accordance with TCFD (Note 1) recommendations, and to incorporate these insights into stakeholder communications.

Adaptation Initiatives

As a founding member of the TCFD, Tokio Marine Holdings has contributed to the promotion and dissemination of climate-related information disclosure as well as the enhancement of investment decision making through transparent reporting. In addition, the company provides comprehensive consulting services to support businesses in aligning their information disclosure practices with TCFD recommendations.

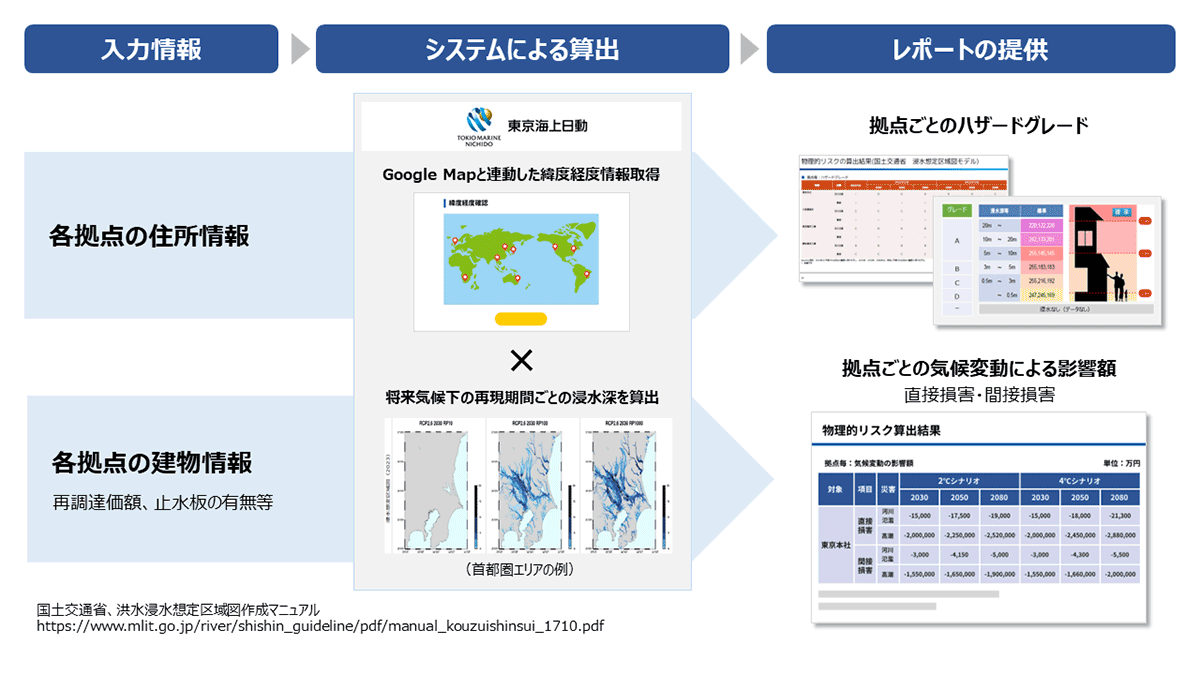

Leveraging our extensive knowledge and expertise, we have developed a system capable of quantifying the financial impact of climate change and offer the "TCFD Disclosure Support System Service" (Fig. 1 and Fig. 2). This system is designed for direct use by customers, and can be used not only as a starting point for corporate GX (Note 2) strategies, but also as a framework for TCFD recommendations and information disclosure based on IFRS S2. By simply entering the address and building information for each site, the system can calculate the hazard levels and financial impacts of climate change for each location and for future years under multiple climate scenarios. For global sites, the system utilizes the WRI Aqueduct (Note 3), while for domestic sites, it uses a model incorporating inundation depth data from the Ministry of Land, Infrastructure, Transport and Tourism.

Effects/Expected Benefits

By utilizing this system service, companies can identify and quantitatively assess climate change risks, which are particularly important for TCFD information disclosure, while also visualizing their future financial impact. In addition, since customers can flexibly adjust the system’s estimation parameters, the system serves not only as a tool for TCFD disclosure, but also as a resource for formulating their own mid- to long-term business strategies and enhancing risk management practices related to climate change.

- Tokio Marine & Nichido Fire Insurance Co., Ltd. "TCFD Information Disclosure Support System Service" (only available in Japanese)

- Tokio Marine & Nichido Fire Insurance Co., Ltd. "News Release: Joint Launch of the TCFD Information Disclosure Support System Service by Tokio Marine & Nichido Fire Insurance and MUFG Bank (December 14, 2023)" (only available in Japanese)