Notes

(*1) Representative Concentration Pathways: Climate change scenarios set by the Intergovernmental Panel on Climate Change (IPCC)

(*2) Climate change scenarios set by the Network for Greening the Financial System (network of financial authorities on climate change risks, etc.)

(*3) As part of the effort, the relationship between global warming and Dai-ichi Life's claims and benefits has been analyzing since FY2020 in collaboration with Mizuho-DL Financial Technology Co., Ltd.

(*4)The IPCC's Sixth Assessment Report uses Shared Socioeconomic Pathway (SSP) scenarios combined with radiative forcing, which assume trends in future socioeconomic development. These are denoted as "SSPx-y," where "x" is the five SSPs and "y" is the approximate radiative forcing (around 2100 as in the RCP scenario). SSP5-8.5 is a high-level reference scenario that does not incorporate climate policies dependent on fossil fuel development. (Prepared by the Company based on an explanatory document in “IPCC no Gaiyo ya Houkokusyo de Siyousareru Hyougen nado ni tsuite” (IPCC Summary and Expressions Used in the Report) (Ministry of the Environment, August 9, 2021))

(*5) FY2019 results are used here to eliminate the impact of increased payments due to COVID-19.

(*6) For example, "Gasparrini, A. et al. Projections of temperature-related excess mortality under climate change scenarios. The Lancet Planet Health. December 2017; 1(9):e360-e367."

Risk Recognition and Use in Strategies in Line with TCFD Recommendations

*This case study is published based on information as of March 2023.

Dai-ichi Life Holdings, Inc.

| Publication date | May 24, 2023 (Posted on May 28, 2024) |

|---|---|

| Sector | Industrial and Economic Activities |

Company Overview

Dai-ichi Life Holdings, Inc. is a financial holding company that is engaged in the business administration of life insurance companies and non-life insurance companies, and is expanding its business not only in Japan but also in nine countries in the Asia-Pacific region where market expansion is expected, and the United States, the world's largest life insurance market. The company positions ensuring the sustainability of society as the cornerstone of its business operations and intends to work harder than ever before to resolve key issues toward this end.

Climate Change Impacts

The Paris Agreement of 2016 has raised awareness of addressing environmental issues as a challenge that should be tackled by the international community. The Group also recognizes addressing climate change as a material management risk that could considerably impact customers' lives and health, corporate activities, social sustainability, and the like.

Adaptation Initiatives

In September 2018, the Group endorsed the Task Force on Climate-related Financial Disclosures (TCFD) recommendations and started its scenario analysis in FY2019. We recognize that climate change could have the following effects in the medium to long term. Based on analyses using the RCP scenario (2.6 and 8.5)(*1) and the NGFS scenario(*2), we promote initiatives to enhance our control measures and the resilience of our business as an insurance provider and an institutional investor.

| Risks |

|

| Opportunities |

|

Scenario Analysis: Impact of Climate Change on Life Insurance Business

The Group works to identify risks related to insurance claims and benefit payments to estimate the impact of climate change on the life insurance business.

Research into rising temperatures is progressing in various fields, and many research institutes have published papers related to this issue, which is attracting more and more attention. In addition to investigating and analyzing such research results, the Group has worked to comprehensively identify risks and quantify their impact based on the characteristics of the insurance products it underwrites (*3).

Based on Dai-ichi Life's actual death benefit payments, in FY2020 we conducted an analysis focusing on increased health hazards caused by rising summer temperatures, which indicated a relationship between peak temperatures across Japan and mortality. We then estimated the increase in insurance payments based on the assumption of future climate scenarios and disclosed the results.

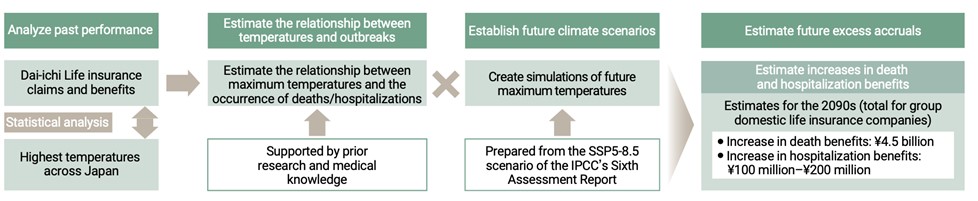

In FY2021, we updated our climate scenario to SSP5- 8.5(*4). We also analyzed the impact on the increase in death benefit payments and income and expenses at the Group's three domestic life insurance companies (Dai-ichi Life Insurance, Dai-ichi Frontier Life Insurance, and Neo First Life). We also analyzed the impact of rising summer temperatures on hospital admissions. After analyzing Dai-ichi Life's past payment records and estimating hospital admissions' relationship with maximum temperatures (and assuming the same climate scenario as for deaths), we estimated the rate of increase in hospitalizations associated with heat-related illnesses (Fig. 1 and table below).

| Item | 2050s | 2090s |

|---|---|---|

| Occurrence of deaths (compared to 2010-2019) | Increase by around 0.2% | Increase by around 0.8% |

| Increase in insurance claims (estimated based on actual death insurance claim payments paid by the three domestic life insurance companies in FY2021 (approx. 580 billion yen)) | 1.3 billion yen increase (income/expense impact of 300 million yen) | 4.5 billion yen (income/expense impact of 1.2 billion yen) |

| Increase in hospitalization benefits (estimated based on actual hospitalization benefit paid by the three Group domestic life insurance companies in FY2019 (approx. 60 billion yen)) (*5) | – | 100-200 million yen |

While this study produced limited results, our analysis of hospitalizations led to a trial calculation based on a considerable number of assumptions on mortality comparisons due to the wide variety of diseases, the amount of statistical data, and the paucity of previous studies. We also need to consider the emergence of new risks in the future.

Effects / Expected Benefits

The Group has begun statistically analyzing the correlation between Dai-ichi Life's past performance and maximum temperatures, using various published papers (*6) as reference. We will work to understand the risks for the entire Group while also considering investigating various disease outbreaks, approaches from a medical perspective, and impact studies of overseas Group companies.

Fig. 1 Analysis of the increase in death and hospitalization benefit payments and their impact on income/expense