Notes

(*1) Scenario references: World Energy Outlook 2022, Net Zero by 2050 Roadmap for the Global Energy Sector, IPCC 6th Assessment Report

(*2) Includes the following scenarios

(a) Scenario in which policies that have already been introduced or announced are implemented

(b) Scenario in which the pledges announced by the world’s government are completely achieved as scheduled

(c) Scenario in which fossil fuels continue to be the main source of energy and GHG emissions keep increasing

(*3) Includes the following scenarios

(a) Scenario in which the global energy sector achieves CO₂net zero by 2050

(b) Scenario in which progress is made toward achieving SDGs is made on a global scale, and the world’s energy demand is satisfied by renewable resources

(*4) Quantitative criteria:

(Large) 1 billion yen or more

(Medium) 500 million yen or more to less than 1 billion yen

(Small) Less than 500 million yen

(-) Qualitative evaluation only

(*5) CCUS: Carbon Dioxide Capture, Utilization and Storage, EOR: Enhanced Oil Recovery

(*6) Carbon neutral is a state where the CO₂ emissions (Scope 1, 2) of our Company and Group are balanced with the credits generated by our Group through the forest conservation project and JCM project or avoided emissions

(*7) Carbon negative is a state where the credits generated by our Company and Group through the forest conservation project and JCM project or avoided emissions exceed(s) the CO₂ emissions (Scope 1, 2) of our Group

Scenario Analysis Based on TCFD Recommendations

Kanematsu Corporation

| Publication date | July 6, 2023 (Posted on February 19, 2024) |

|---|---|

| Sector | Industrial and Economic Activities |

Company Overview

Kanematsu Corporation is a trading company founded in 1889. The Kanematsu Group provides a wide variety of products and services in four business segments: "Electronics & Devices", "Foods, Meat and Grain", "Steel, Materials & Plant", and "Motor Vehicles & Aerospace", organically combining its domestic and international networks and expertise in each business field with the functions of a trading company, including commercial transactions, information gathering, market development, business development and structuring, risk management, and logistics.

Climate Change Impacts

The following four events are feared to affect Kanematsu Corporation's business due to climate change.

- Intensification of extreme weather events such as cyclones and floods

- Rise in average temperatures

- Changes in precipitation and weather patterns

- Rise in sea levels

These events may cause damage to equipment and facilities, loss of sales opportunities due to supply chain disruption, and relocation costs.

Adaptation Initiatives

The Company endorsed the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) in June 2021, and has been disclosing the results of its scenario analysis, impact assessment, and consideration of countermeasures since June 2022. A summary of the results is as follows.

- Selection of Businesses for Scenario Analysis

The impact of climate change on the Group was classified based on the quantitative aspect of sales, and we selected the North American beef business and the steel tubing business, which have large qualitative and quantitative impacts related to climate change.

- Selection of Climate Scenarios

For scenario analysis, we referred to information from international organizations (*1) and selected the 4°C scenario (*2) and the below 2°C scenario (*3) for the years 2030 and 2050.

- Impact of Climate-related Risks and Opportunities

For each scenario, the impact on revenues or costs of the subject businesses (North American beef and steel tubing businesses) was evaluated using the following quantitative criteria: large, medium, and small (Fig. 1, *4).

- Results of Scenario Analysis

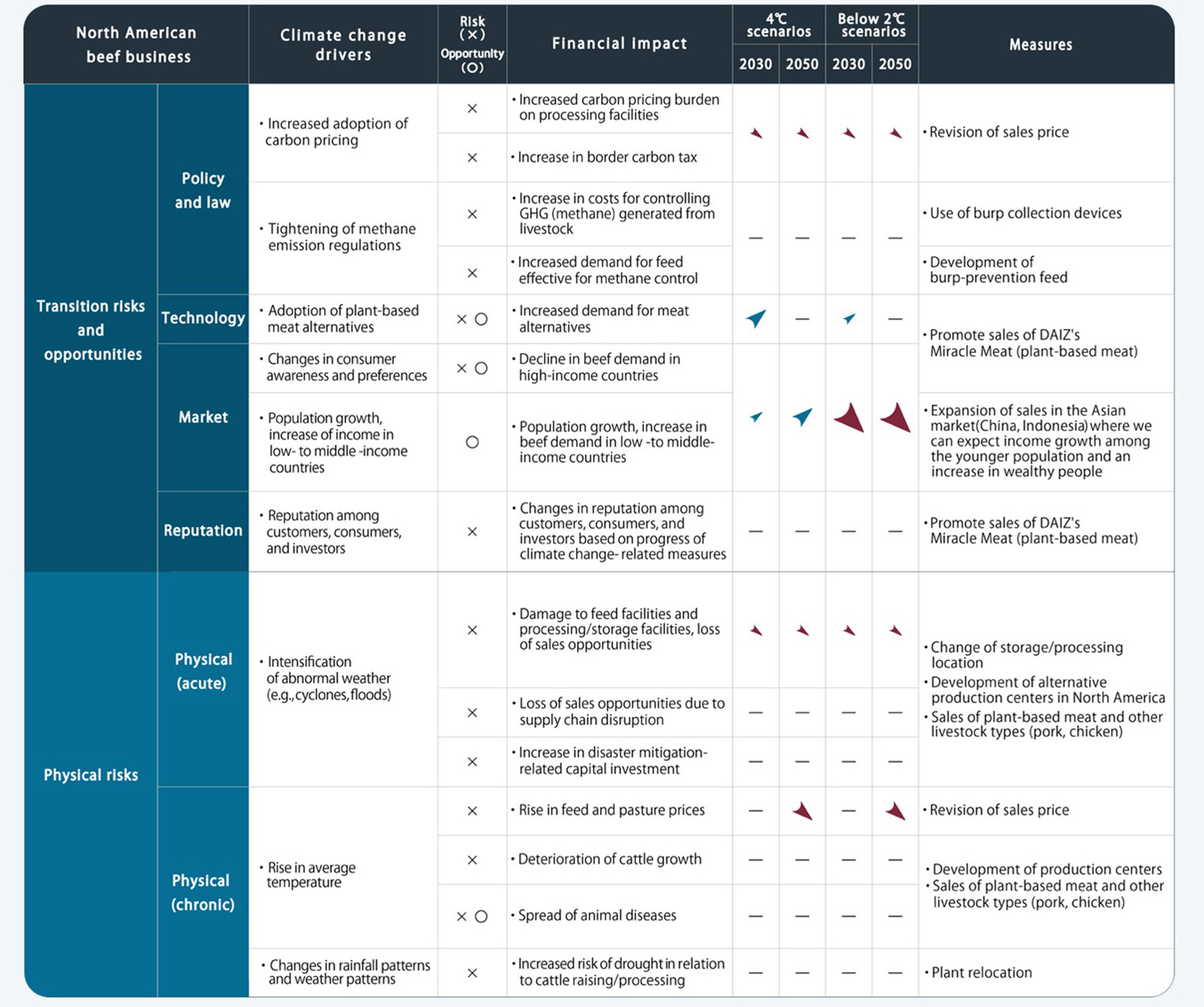

- North American Beef Business

Opportunities: New opportunities associated with the development/adoption of new technologies (plant-based meat)

Physical risks: Rise in feed and pasture prices due to higher average temperatures

As for the impact of physical risks, in both scenarios, damage to feeding facilities, processing and storage facilities, and loss of sales opportunities due to severe extreme weather events such as cyclones and floods, and rise in feedstuff and forage prices due to higher average temperatures were evaluated as relatively significant (Fig. 2). - Steel Tubing Business

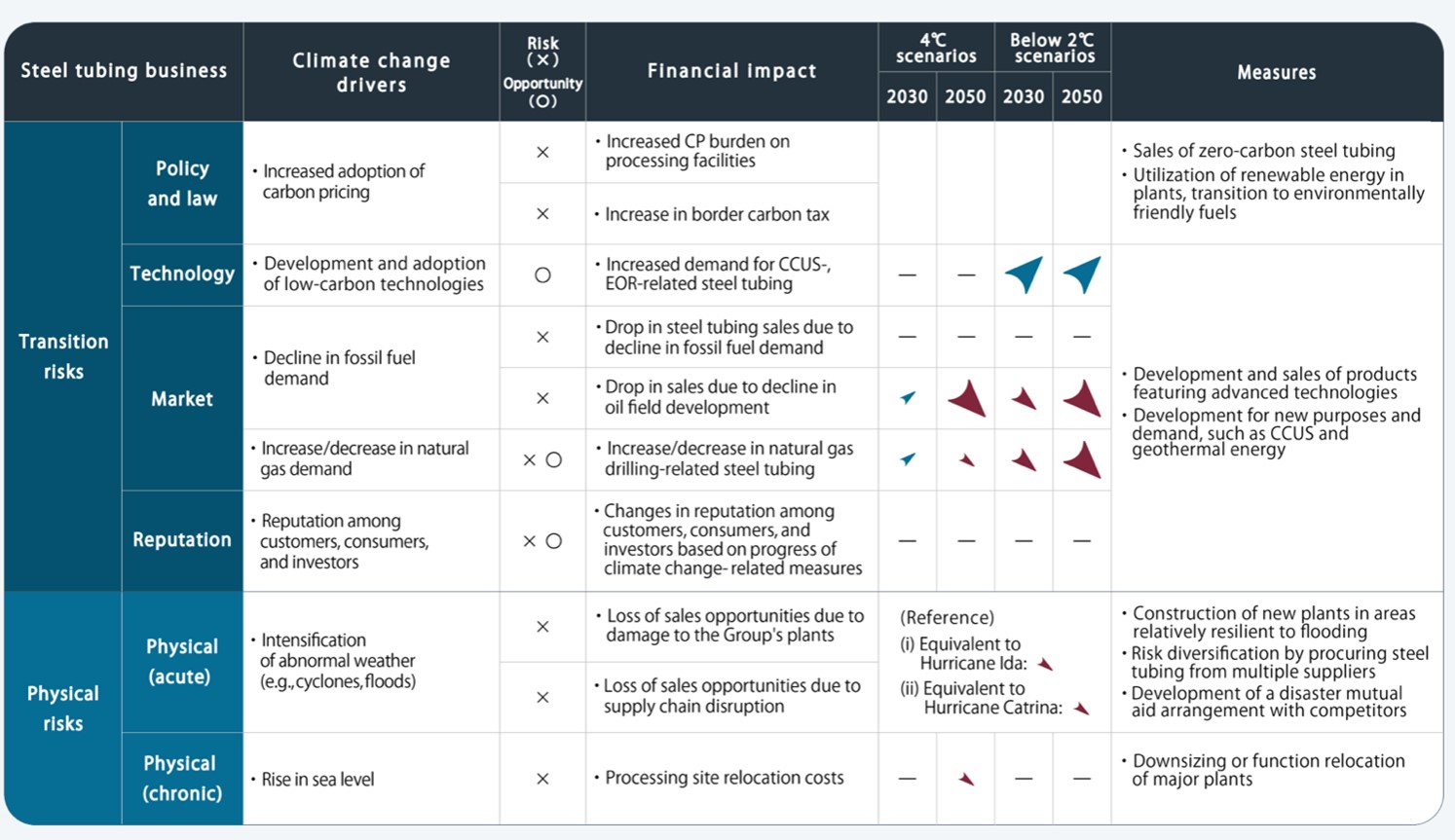

Opportunities: New opportunities associated with the development/adoption of new technologies (CCUS, EOR)(*5)

Physical risks: Damage to plants due to severe extreme weather events such as cyclones and floods

The impact of physical risk was assessed as loss of sales opportunities due to damage to company-owned factories and loss of sales opportunities due to disruption of supply chains caused by disasters equivalent to Hurricane Ida and Hurricane Catrina, and relatively high relocation costs of processing facilities due to sea level rise in 2050 under the 4°C scenario (Fig. 3).Transition Risk: Decreased demand for fossil fuels

As an impact of the transition risk, a relatively large decrease in sales is expected under the below 2°C scenario due to the expected decline in oil field development as a result of a significant decrease in demand for fossil fuels (Fig. 3).

Effects / Expected Benefits

The results of the scenario analysis identified that risks and opportunities could exist in both of the two targeted businesses.

Based on the results of the analysis, the Kanematsu Group has formulated a business strategy that sees climate change as an opportunity, and is promoting investment in business fields with environmental and other themes as a priority measure in its six-year medium-term vision through the fiscal year ending March 31, 2024. Furthermore, our Group has actively engaged in a forest conservation project and Joint Crediting Mechanism (JCM) project in recent years. Through these projects, we plan to offset all our CO₂ emissions with credits generated by our Group or avoided emissions to be converted into credits (become carbon neutral(*6)) as soon as possible and eventually aim to become carbon negative(*7) so that we can keep on contributing to Japan and the international community.

Fig. 1 Financial impact

Fig. 2 Financial impact example

Fig. 3 Impact assessment results and measures in steel tubing projects