Footnotes

(Note 1) Physical risks refer to the potential intensification or increased frequency of extreme weather events due to climate change, or long-term shifts in climate patterns. These are further categorized into acute risks, such as increased flooding and other extreme weather events, and chronic risks, such as the prolonged impact of high temperatures on agriculture and fisheries.

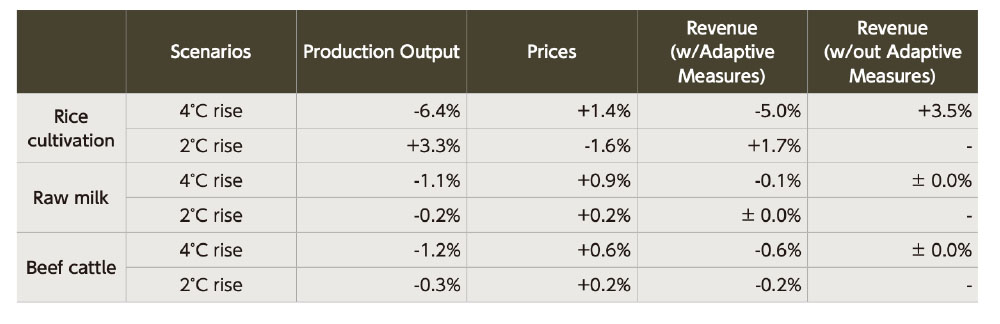

(Note 2) This analysis estimates changes in income at the end of the 21st century compared to the end of the 20th century under two conditions: (1) no adaptation measures are taken in response to rising temperatures, and (2) adaptation measures are implemented. The scenarios used in this analysis are based on the IPCC's RCP 2.6 (hereafter “2°C scenario”) and RCP 8.5 (hereafter “4°C scenario”), resulting in a total of four scenario combinations.

The scenario analysis for the agricultural sector involves multiple assumptions and hypotheses due to several limitations of the modeling approach: (1) methods are not yet internationally established, (2) data availability is incomplete, and (3) impact pathways are diverse and complex.

It should also be noted that this analysis focuses on revenue, not income (i.e., revenue minus costs), and thus may differ from the actual impact on agricultural profitability.

Disclosure Based on TCFD and TNFD Recommendations

*This case study includes a scenario analysis focusing primarily on the impacts of physical risks.

The Norinchukin Bank

| Last Updated | January 20, 2025 (Posted on July 10, 2025) |

|---|---|

| Publication date | September 29, 2022 |

| Sector | Industrial and economic activities |

Company Overview

The Norinchukin Bank is a national financial institution founded on a cooperative framework that supports Japan’s agriculture, forestry, and fishery industries. Our mission is to contribute to the development of these sectors—and by extension, to the national economy—through the facilitation of financing.

We provide loans to cooperative members (such as JA Bank, JF [Japan Fisheries Cooperatives], and JForest [National Federation of Forest Owners’ Cooperative Associations]), as well as to agriculture, forestry, and fishery-related businesses and organizations. In addition to domestic financing, we engage in a wide range of investments and lending activities both in Japan and overseas.

Climate Change Impacts

In recent years, increasingly severe natural disasters and extreme weather events have disrupted crop production cycles. In addition, environmental changes —such as declining fish catches and shifts in fish species— have made it more difficult for agriculture, forestry, and fisheries businesses to maintain stable operations.

Our foundation in the agriculture, forestry, and fisheries sector makes us not only vulnerable to the negative impacts of climate change but also aware of the potential for these sectors to contribute to its acceleration.

Adaptation Initiatives

Based on the recognition that addressing climate change is essential to ensuring the sustainability of the agriculture, forestry, and fisheries sectors, we are promoting both mitigation and adaptation efforts through our business activities, with a focus on the risks and opportunities associated with climate change.

As part of these efforts, we endorsed the TCFD recommendations in 2019 and have since been working to enhance our initiatives and disclosures in line with the TCFD framework.

Furthermore, in response to the global challenge of shifting financial flows toward nature-positive outcomes by disclosing nature-related risks and opportunities, the final version of the TNFD recommendations was published in September 2023.

Recognizing that nature-related issues are inseparable from the agriculture, forestry, and fisheries industries themselves, we have contributed to the development of the TNFD disclosure framework as a member of the TNFD Taskforce since November 2022. In November 2023, we declared our status as an Early Adopter of the TNFD and are now aiming to disclose information based on the TNFD recommendations.

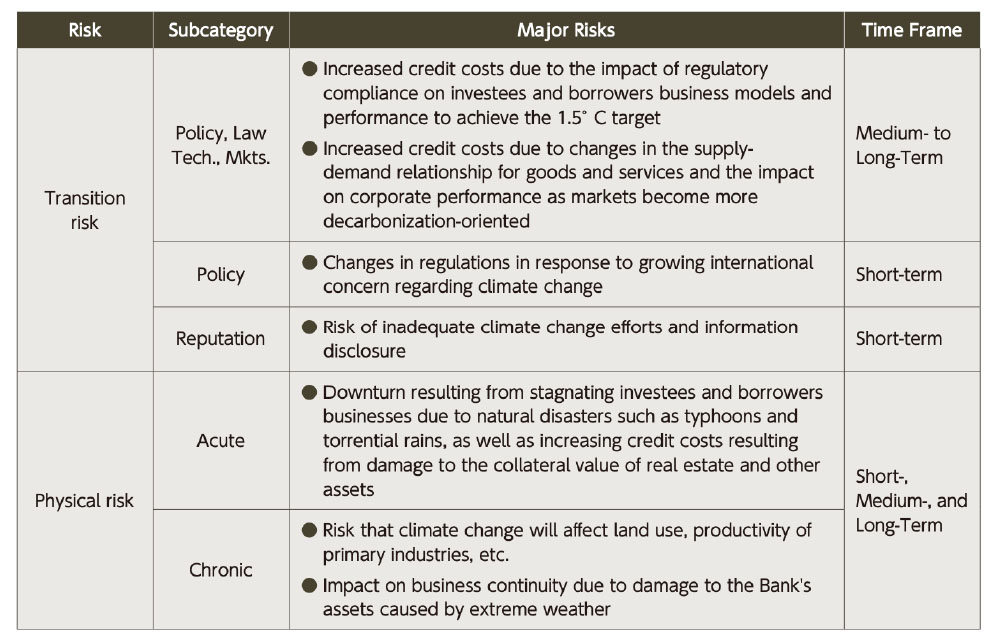

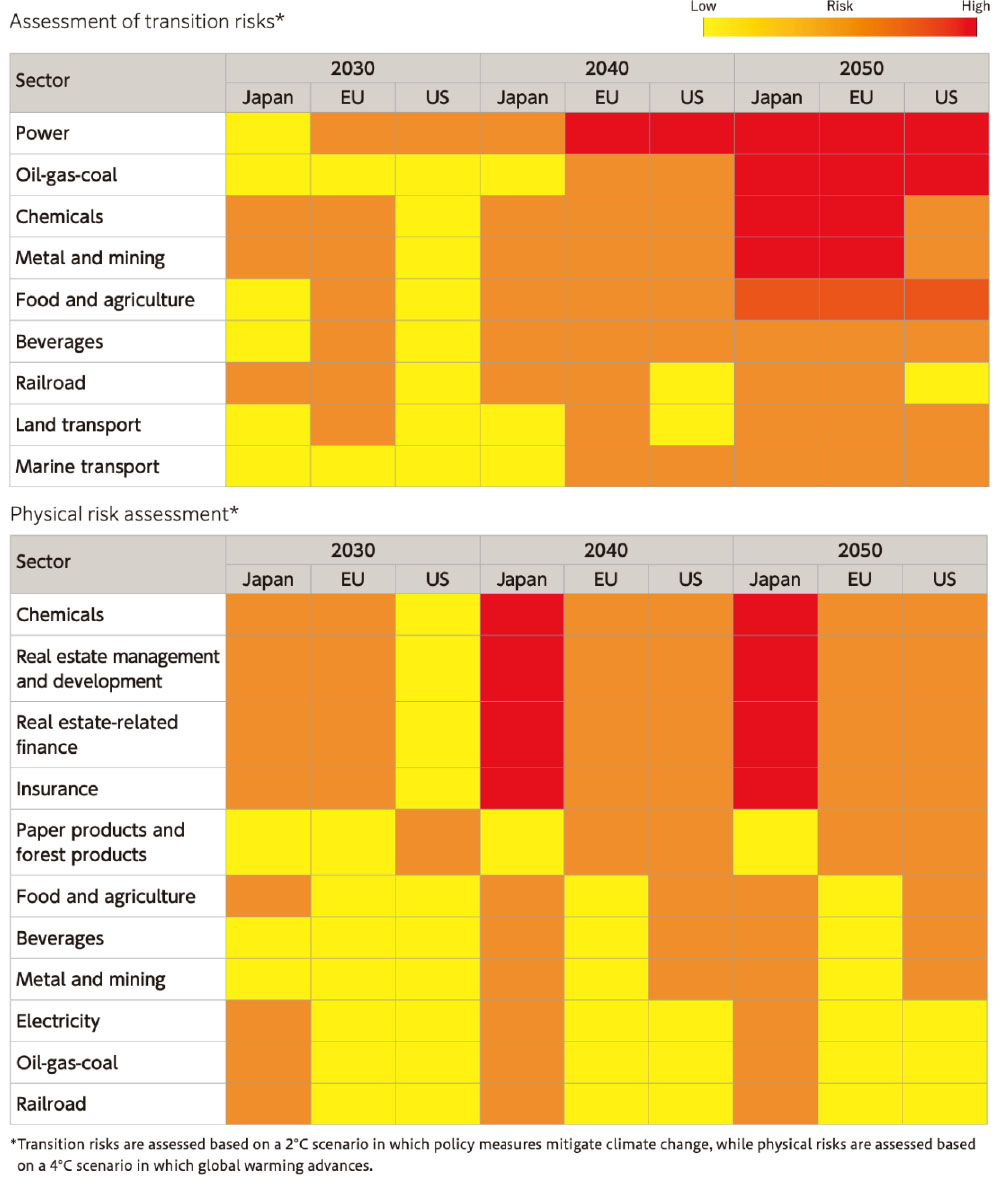

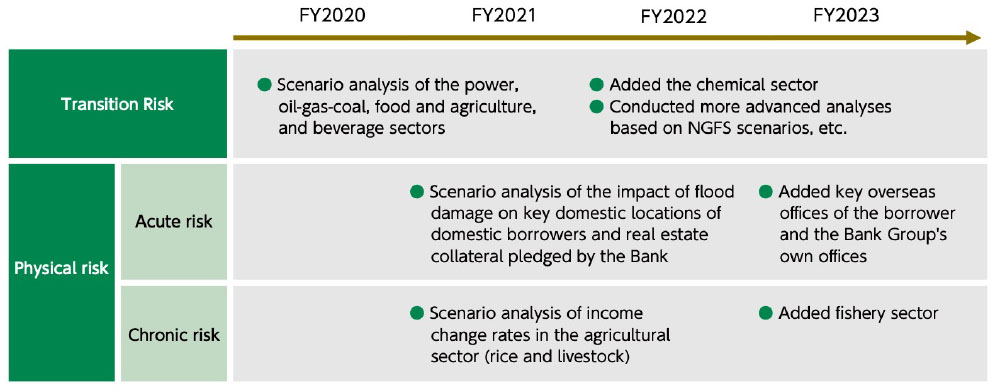

We have conducted a climate risk assessment (Note 1, Fig. 1, Fig. 2) and are now conducting scenario analysis to evaluate their potential impacts on our credit portfolio, financial position, and other aspects (Fig. 3).

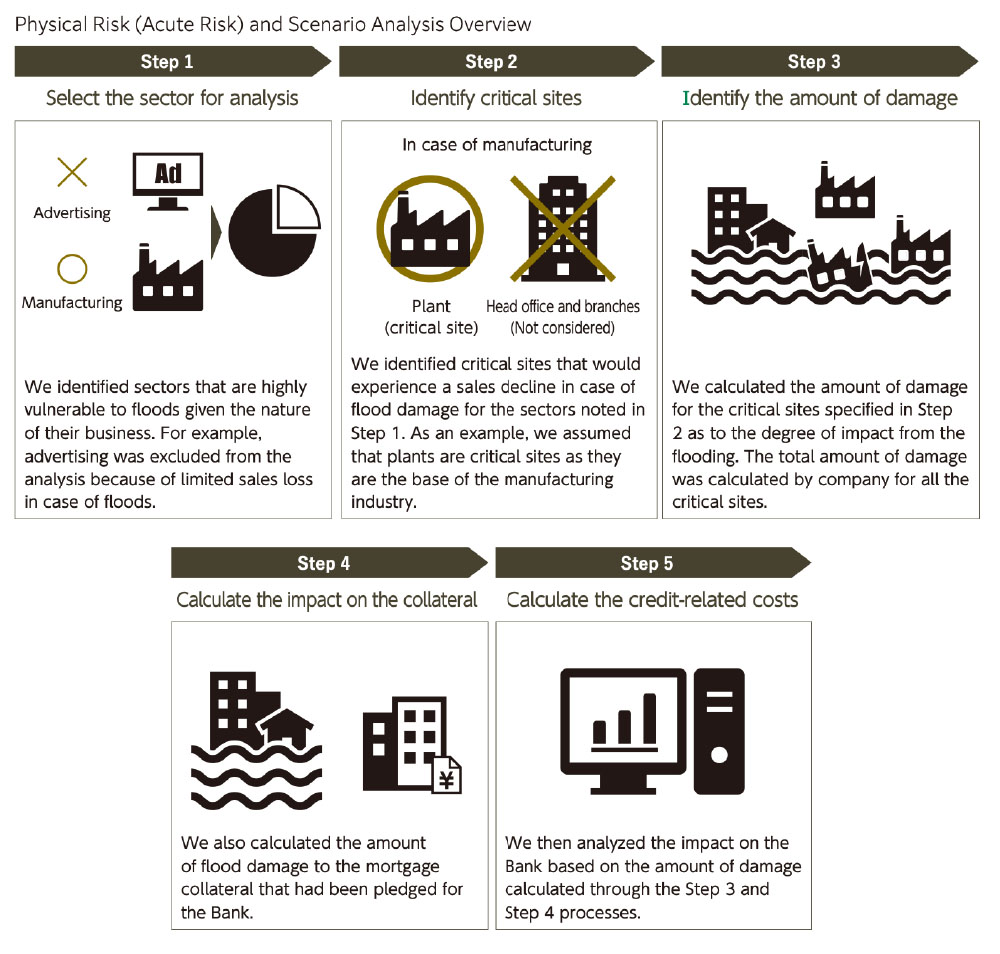

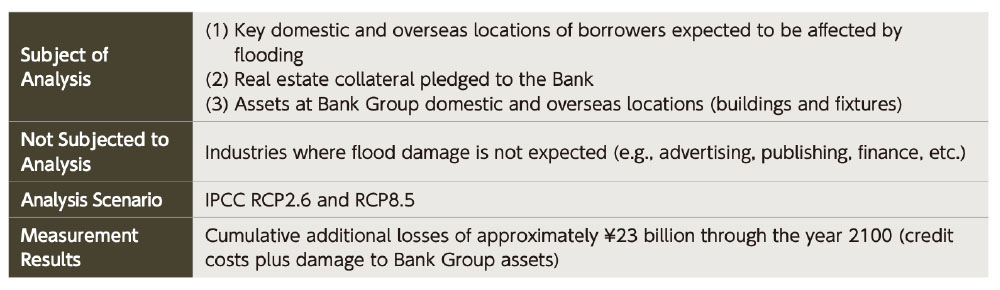

Regarding physical risks—particularly acute risks—we conducted an analysis of flood-related damage, which has caused severe impacts in recent years (Fig. 4).

This analysis covers not only the global key sites of domestic and international borrowers and real estate collateral held by us, but also the assets (e.g., buildings and equipment) of our own group offices.

Our scenario analysis for acute physical risks estimated cumulative additional losses of approximately 23 billion yen by 2100, including credit costs and damage to our Bank Group’s assets. The results indicated that the overall financial impact of these additional losses is expected to be limited (Fig. 5).

For chronic physical risks, we selected “agriculture” and “fisheries” as key sectors for analysis, given their importance to our institution, which is rooted in the agriculture, forestry, and fisheries industries.

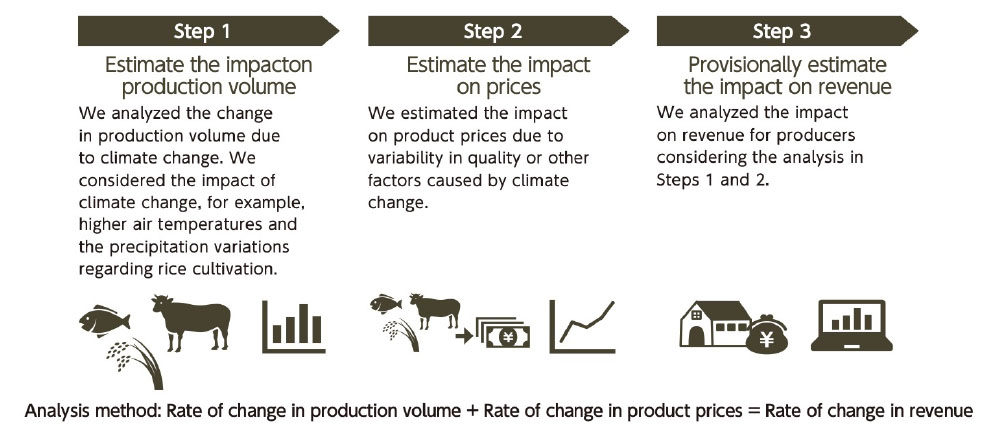

Targeted commodities included rice cultivation, livestock production (raw milk and beef cattle), and offshore fisheries (bonito). The analysis examined the impacts of climate change—including rising temperatures and sea surface temperatures—on producers’ and fishers’ incomes, as well as the effectiveness of potential adaptation measures (Note 2, Fig. 6).

In the agriculture sector, the scenario analysis found that while climate change is expected to reduce income, the introduction of adaptation measures could help maintain income at a stable level (Fig. 7).

In the fisheries sector, the analysis revealed that income impacts are likely to vary by region due to climate change, but the adoption of adaptation strategies could help mitigate such declines (Fig. 8).

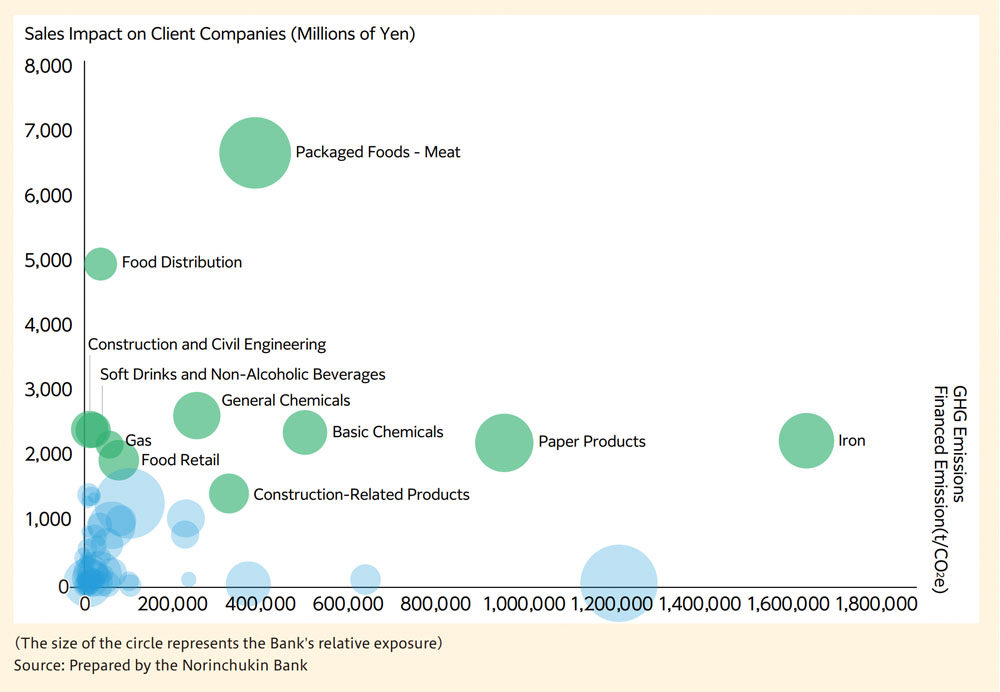

Furthermore, based on the results of the acute risk scenario analysis, an additional assessment was conducted from the perspectives of natural capital and biodiversity. This analysis focused on flood-related acute risks affecting key domestic and international borrower sites and pledged real estate collateral.

Specifically, the relationship between flood-related sales impacts on client companies and their dependence on water resources was visualized on a sector-by-sector basis. The results showed that sectors with high water dependency tend to have critical facilities—such as factories—located near rivers or coastlines, making them more susceptible to physical risks.

As a broader trend, the consumer staples and materials sectors were identified as having high water dependency and relatively greater exposure to physical risk (Fig. 9).

Given the significant scale of our investments and loans in the food sector (e.g., packaged foods, meat, brewing, alcoholic beverages), a more detailed analysis was conducted for this sector.

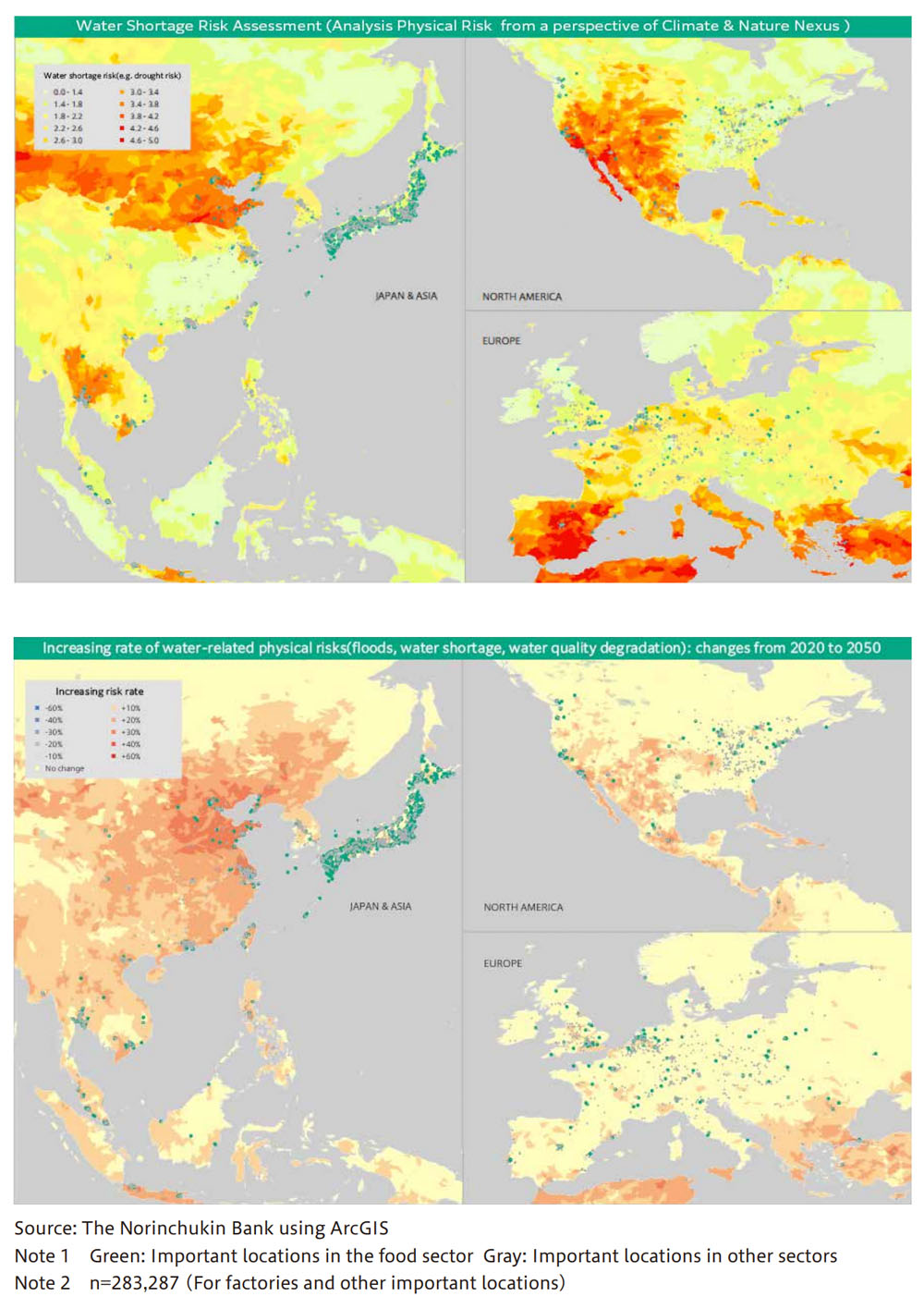

To visualize the status of water-related risks, key borrower facility locations were mapped onto a risk heatmap that incorporated both drought risk (as a physical risk from climate change and natural capital degradation) and future flood risk (Fig. 10).

Effects / Expected Benefits

Building on scenario analyses of physical risks and related financing initiatives, we are promoting collaboration with a wide range of stakeholders from the perspective of climate change adaptation. This includes engagement with investees and borrowers, as well as contributing to the dissemination of our adaptation initiatives through dialogue with institutions such as the Ministry of the Environment and the Ministry of Economy, Trade and Industry.

In our sustainable finance initiatives, we are addressing not only mitigation, but also adaptation considerations.

Case 1: Provided financing for a seawater desalination project in the Middle East to strengthen adaptive capacity in water supply, in response to growing concerns about declining access to water resources due to drought and other factors.

Case 2: Invested in Sustainability Awareness Bonds issued by the European Investment Bank, thereby supporting the development of infrastructure that contributes to the management of natural disaster risks, such as flooding.

Case 3: Through the Norinchukin Innovation Fund, we invested in Ac-Planta Inc., a company engaged in the research, development, manufacturing, and sale of biostimulants that are resistant to drought, high temperatures, and salt damage.

Case 4: In response to the extensive damage caused by a series of natural disasters in Japan to the production base of the agriculture, forestry, and fisheries sectors, we, together with JA Bank and JF Marine Bank, implemented various financial support measures—such as the provision of low-interest disaster relief funds and subsidized interest on agricultural funds—to facilitate smooth cash flow for producers.

We will continue to work in close partnership with stakeholders to fulfill our role as a financial institution that actively supports effective climate change adaptation.

Fig. 1: Climate Change Risks Recognized by The Bank

Fig. 2: Climate Change-Related Risk Assessment by Sector

Fig. 3: Scenario Analysis Overview

Fig. 4: Physical Risk (Acute) and Scenario Analysis Overview

Fig. 5: Acute Physical Risk Analysis Overview

Fig. 6: Physical Risk (Chronic) and Scenario Analysis Overview

Fig. 7: Overview of Chronic Physical Risk Analysis in the Agricultural Sector

Fig. 8: Overview of Chronic Physical Risk Analysis in the Fisheries Sector

Fig. 9: Relationship between Sales Impact of Client Companies Due to Flood Damage and Their Dependence on Water Resources

Fig. 10: Visualized Drought Risk (top) and Water-Related Physical Risk (bottom)