Initiatives for TCFD Final Recommendations

*This case study is published based on information as of August 2024.

Nomura Research Institute, Ltd.

| Publication date | September 30, 2024(Posted on July 3, 2025) |

|---|---|

| Sector | Industrial and Economic Activities |

Company Overview

Nomura Research Institute (NRI) Group creates new social value by providing integrated services ranging from consulting to IT solutions, driving organizational and business transformation of its clients, and ultimately, fostering broader societal change. We have developed a unique business model by combining its consulting expertise, which leads clients from issue identification to effective solutions, with its IT solutions capabilities, which leverage advanced technologies to develop and operate systems that address complex challenges.

Although future trajectory of climate change remains highly uncertain, its effects are becoming increasingly apparent, and the pressure on companies to decarbonize continues to grow. Within the NRI Group, delays in transitioning to renewable energy or reducing greenhouse gas emissions (Scope 1, 2, and 3), as outlined in our environmental goals, could lead to increased physical and transition risks associated with climate change. Additionally, if societal expectations for climate action accelerate and the Group fails to respond in a timely manner, there is a risk of declining profitability and potential damage to our corporate reputation.

Adaptation Initiatives

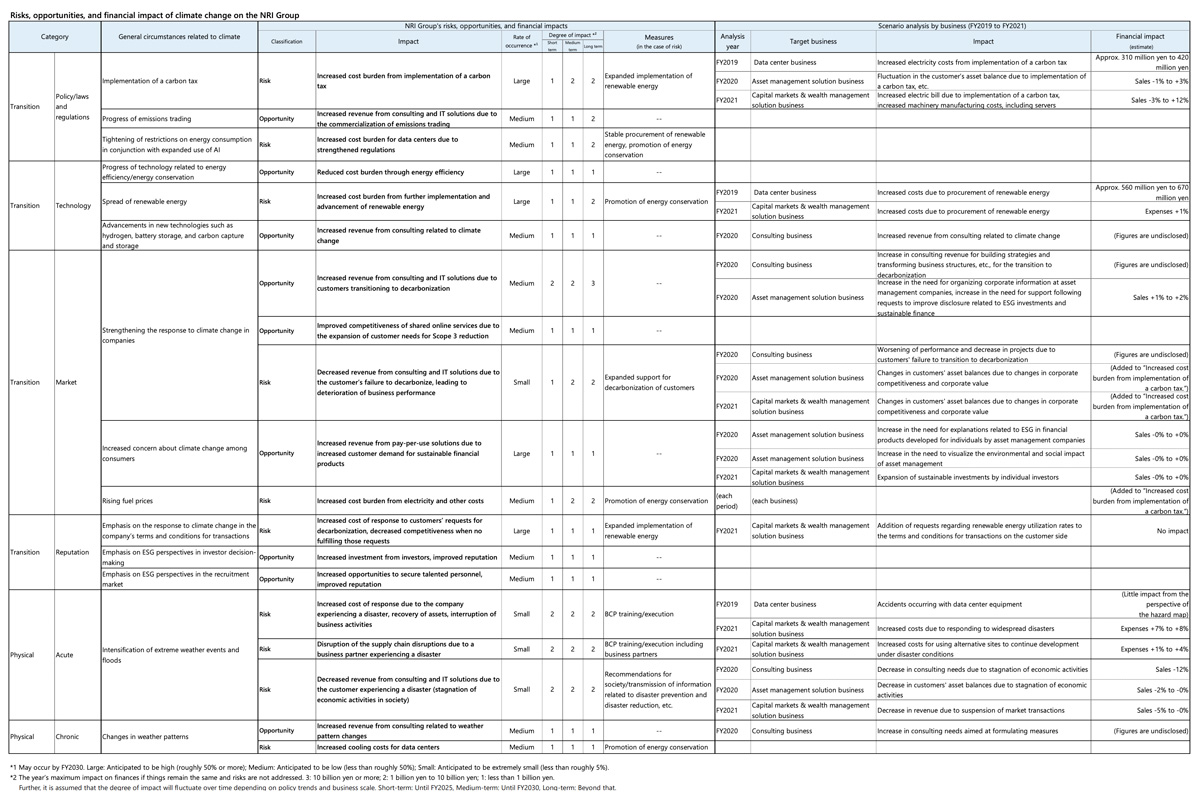

The NRI Group expressed its support for the TCFD's final recommendations in July 2018 and conducted scenario analysis from FY2019 to FY2021 to identify risks and opportunities in individual businesses and assess their financial impact on the Group. The results of these analyses have been disclosed through the Group's website.

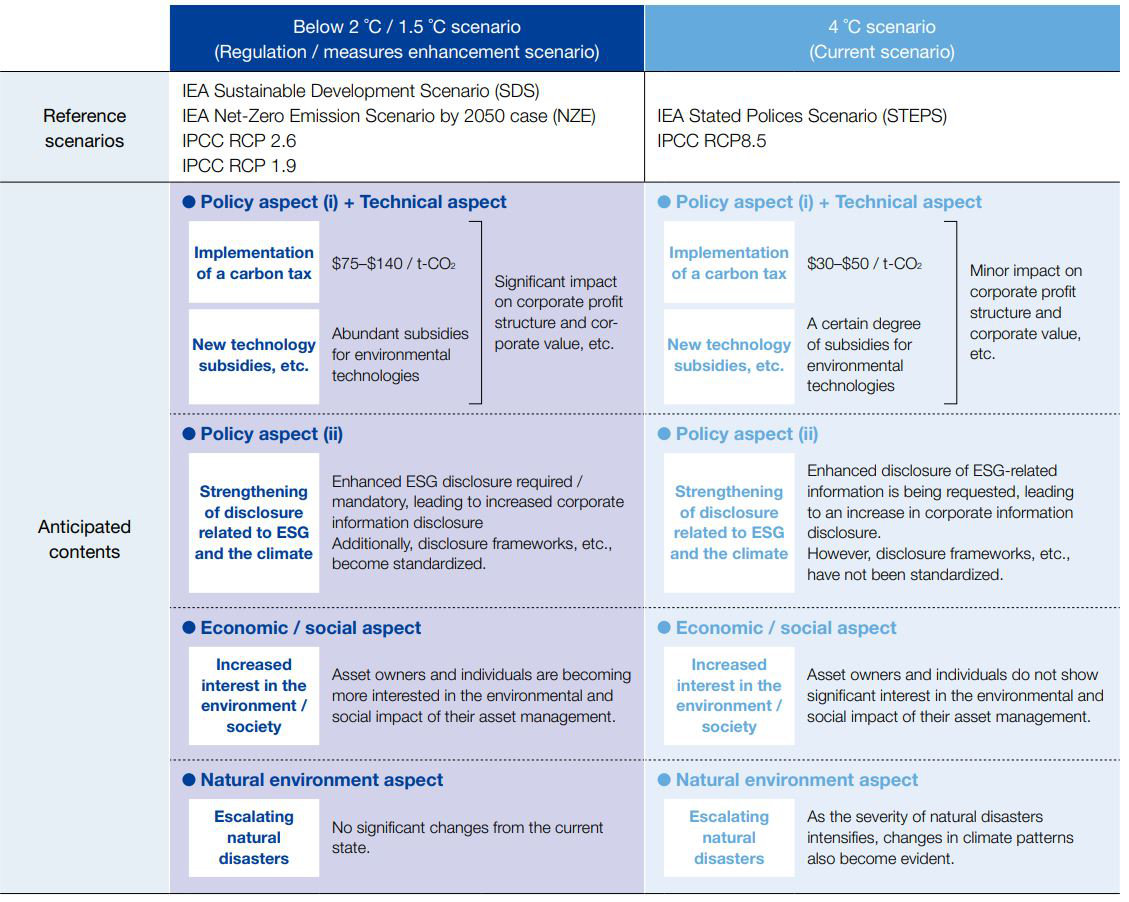

In FY2023, building upon these findings, we reviewed the risks, opportunities, and financial impacts across the Group’s entire business portfolio. For this analysis, two scenarios were assumed: the "1.5°C scenario" with strengthened regulations and measures, and the "4°C scenario" under the current scenario. (Fig.1 and Fig. 2).

For some of the key risks and opportunities identified, we have estimated the financial impact on the Group's overall business as follows.

[Estimated Financial Impact of Individual Risks and Opportunities (Assumed for FY2030)]

| Classification | Impact | Estimated value | Assumptions of estimate, possibility of risk mitigation, etc. | |

|---|---|---|---|---|

| Transition | Risk | Increased cost burden from implementation of a carbon tax | Approx. 1 billion yen to 2 billion yen | The tax amount is calculated from the net greenhouse gas emissions assuming business expansion without changing the current renewable energy usage (carbon tax price is based on the IEA scenario). However, if the renewable energy usage rate reaches 100% by FY2030 according to the low-carbon transition plan, the tax amount can be almost zero. |

| Transition | Opportunity | Increased revenue from consulting and IT solutions due to customers transitioning to decarbonization | Approx. 6 billion yen to 7 billion yen | Assumes expansion of consulting themed on decarbonization in line with the growth of consolidated sales from current orders, recording the entire increase. Similarly, for the business platform business, it assumes expansion in line with the growth of consolidated sales, recording 10% of the increase as resulting from customer transition to decarbonization. |

| Physical | Risks | Interruption of business activities due to the company experiencing a disaster | Approx. 1 billion yen to 2 billion yen | The decrease in sales was calculated on the assumption that the business platform operation revenue of the NRI Group is not obtained for 2 days due to impact on the infrastructure (electricity, water, communication, etc.) around the Data Center from large-scale flooding, etc. However, the possibility of this risk materializing is considered extremely low due to various measures and training to prevent system stoppage, such as using Osaka Data Center II as a DR site if the Tokyo Data Center is not operational. |

| Physical | Risks | Disruption of the supply chain disruptions due to a business partner experiencing a disaster | Approx. 2 billion yen to 3 billion yen | Assumes a decrease in sales due to project delays, on the assumption that 10% (based on procurement amount) of business partners commissioned for system development by the NRI Group cannot operate for one month due to large-scale flooding. |

Based on the results of the scenario analysis, our Group is taking action based on the recognition that efforts to reduce greenhouse gas emissions through the introduction of renewable energy and other measures will mitigate the risks associated with the introduction of a carbon pricing (carbon tax, etc.) and increasing demands for environmentally responsible behavior.

Additionally, within our environmental management system, we conduct comprehensive environmental impact assessments. Our analysis of greenhouse gas emissions revealed that the majority stem from electricity consumption at data centers. Given this, we have identified energy efficiency improvements and transitioning to renewable energy as essential initiatives for decarbonization.

In line with this recognition, our Group has fully transitioned all electricity used at our data centers in Japan to renewable energy. Furthermore, we are actively working to convert the electricity used in our key office locations to renewable energy sources.

Effects/Expected Benefits

Since FY2018, the NRI Group has identified, assessed, and addressed climate-related risks and opportunities through its Sustainability Promotion Committee. This includes evaluating climate-related risks, such as business continuity risks caused by increasingly severe natural disasters. The committee considers various factors, including the external environment, the status of relevant initiatives, and information from service divisions, to deliberate and determine appropriate measures for each climate-related risk.

In recognition of its scenario analysis and transparent information disclosure, NRI was selected in March 2024 as one of the "Excellent TCFD Disclosure" companies by the Government Pension Investment Fund (GPIF), which oversees domestic equity investments.

(click here to enlarge)

*In the table’s category column, items labeled "Transition" primarily correspond to risks and opportunities under the "1.5°C Scenario," while those labeled "Physical" primarily correspond to the "4°C Scenario."