Footnote

(Note 1) 2.6°C scenario: governments materialize the environmental policies which have already been published; consistent with Stated Policies Scenario (STEPS) in IEA's World Energy Outlook 2021 (WEO2021).

Well-below 2°C scenario: assumes that nations cooperate to achieve the SDGs, resulting in good progress on climate change mitigation; consistent with IEA's Sustainable Development Scenario (SDS).

1.5°C scenario: assumes that the net zero emissions are achieved globally by 2050; consistent with IEA's Net Zero Emission by 2050 Scenario (NZE).

(Note 2) As an example of physical risk, transport volumes may decrease due to supply chain disruptions caused by floods and typhoons, we believe the impact will be small because business risks are generally hedged through contractual arrangements such as time charter contracts and securing alternative routes.

(Note 3) EU-ETS refers to European Union Emissions Trading System. Under the proposed legislation, international shipping operations’ emissions will be subject to taxation in EU-ETS from FY2024.

(Note 4) Assumptions for estimation: (1) GHG emissions based on our actual operations in 2020; (2) an EU-ETS carbon price of US$70 and (3) the application of charges to 100% of GHG emissions, indicates that we would be required to pay charges of around 5 billion yen per year.

Scenario Analysis and Response Measures Based on TCFD Recommendations

Mitsui O.S.K. Lines, Ltd.

| Updated | January 23, 2023 (Posted on April 24, 2023) |

|---|---|

| Publication date | June 18, 2020 |

| Sector | Industrial and economic activities |

Company Overview

Mitsui O.S.K. Lines, Ltd. (MOL) is a multimodal transport group that meets diverse transport needs with one of the world’s largest merchant fleets and a comprehensive approach to safety.

To further contribute to economic growth, the MOL Group works toward its ideal on the global stage: becoming an excellent and resilient company that leads the worldwide shipping industry.

Climate Change Impacts

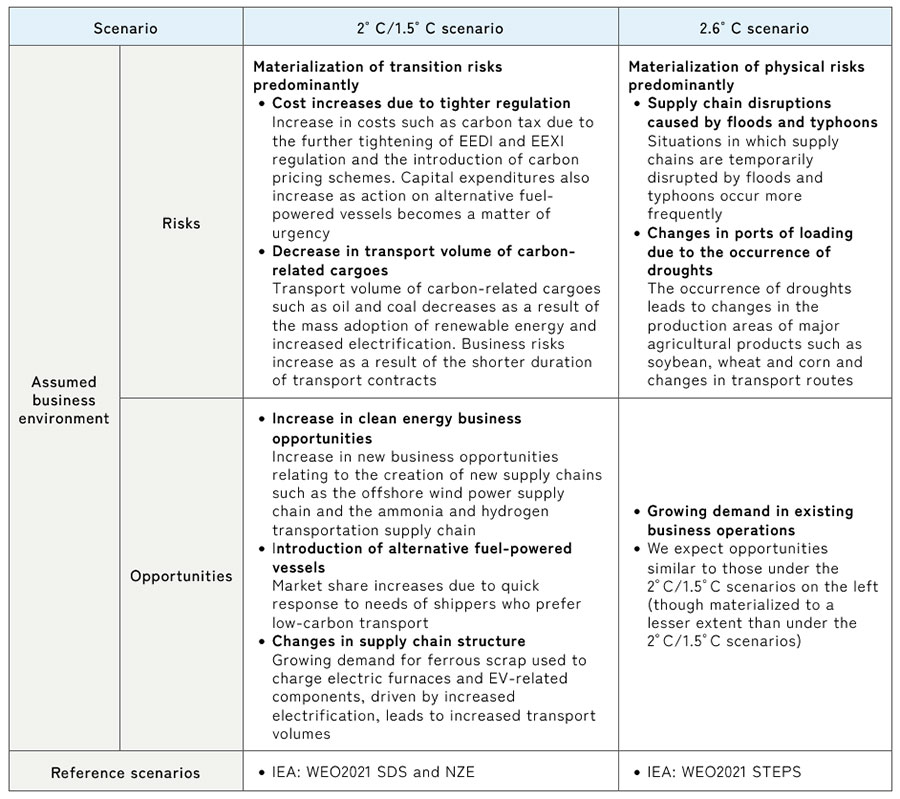

Physical risks that may impact our company include temporary obstacles to transport due to supply chain disruptions caused by floods and typhoons, and changes in transportation routes associated with changes in grain production areas caused by drought. Transition risks include the obsolescence of fossil-fueled vessels due to the spread of new marine fuel engines, and opportunities include increased demand from shippers seeking lower-carbon supply chains by the introduction of alternative fuel-powered vessels.

Adaptation Initiatives

We endorsed the TCFD recommendations in November 2018, and participated in the " Project to Support Climate Risk/Opportunity Scenario Analysis in Accordance with TCFD" by the Ministry of the Environment to conduct scenario analysis. In FY2021, we enhanced our study by conducting an analysis based on multiple scenarios, including the "1.5°C scenario" which assumes more advanced worldwide action on climate change than the scenarios previously studied. Given also TCFD's new guidance, which was published in October 2021 and expands the scope of recommended disclosures, MOL is committed to making more specific, clearer disclosures.

Assumed scenario

We assumed three scenarios targeting FY2050 (2.6°C scenario, well-below 2°C scenario and 1.5°C scenario (Note 1, Fig. 1). With respect to changes in cargo movements, each sales division, under the initiative of the Corporate Planning Division has prepared long-term forecasts that take the impacts of climate change into consideration.

Scenario Analysis Results

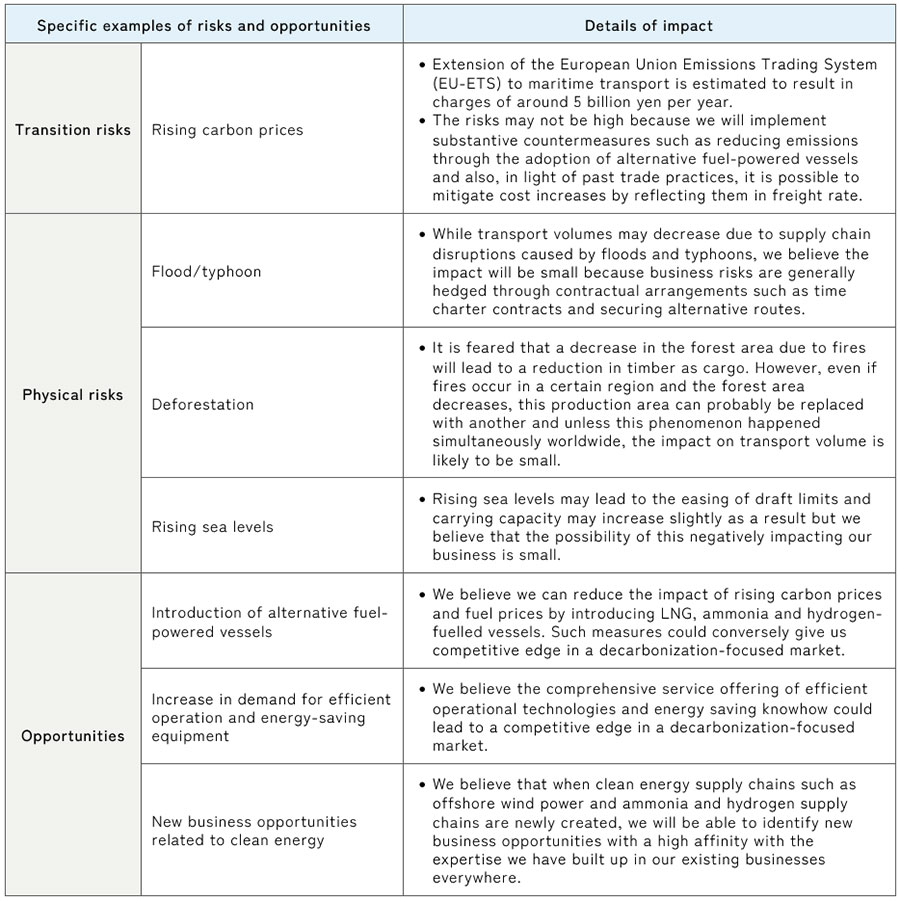

The results of scenario analysis suggest that increases in carbon tax and fuel cost would have a significant impact on the transportation business but we believe we can reduce this impact through the introduction of alternative fuel-powered vessels, which is currently underway. Assuming that physical risks such as floods, typhoons and deforestation become even more severe, we recognize that these risks are hedged through measures such as the current transportation contracts and secured transportation routes, and therefore the impact of these risks is limited compared to other industries (Fig. 2, Note 2).

Financial Impact Assessment Results

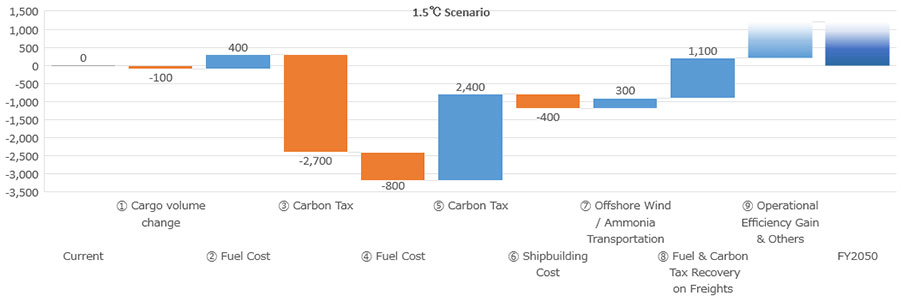

We have evaluated the quantitative impact of the realization of each scenario on MOL businesses. In our evaluation, we focused specifically on changes in cargo movements, fuel cost, carbon tax, the introduction of alternative fuel-powered vessels and new business opportunities. Under the 1.5°C scenario (Fig. 3), carbon tax will be a major factor in worsening profitability (negative impact of 270 billion yen). However, we expect to be able to achieve a sufficient level of profit by significantly reducing carbon taxation through the active introduction of next-generation fuel-powered vessels (positive impact of 240 billion yen) and by taking appropriate countermeasures such as expanding new business opportunities that tap into growing demand in the clean energy business domains including offshore windfarms and hydrogen and ammonia transportation (positive impact of 30 billion yen) and initiatives to broadly share the increased costs of carbon tax beyond the industries (positive impact of 110 billion yen), efficient operations and other new business.

Examples of measures to address risks/opportunities

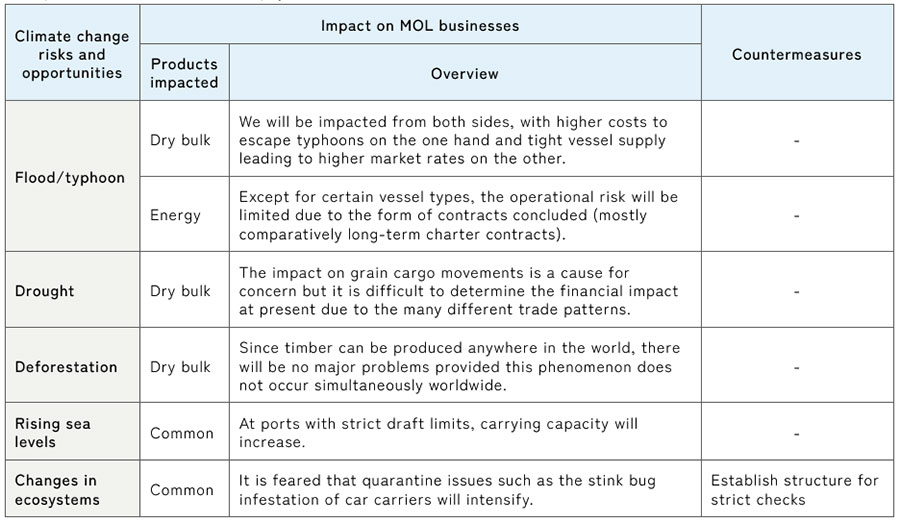

We plan to implement various measures to demonstrate resilience to the impacts in all three scenarios. Effective adaptation measures to physical risks due to climate change include reducing physical risks by ensuring appropriate measures in commercial practices, such as mitigating operational risks through contracts against events such as typhoons and droughts (Fig. 4).

Effects / Expected Benefits

In order to improve our risk management, we have classified key business risks, mapped these business risks based on degree of impact and probability of occurrence, and identified priority issues.

We were able to identify the changes in the society and our strengths through scenario analysis, which lead to expanding new business opportunities that tap into growing demand in the clean energy business domains including offshore windfarms and hydrogen and ammonia transportation. Drawing on expertise in the development of marine infrastructure accumulated in its marine transportation business, MOL has already begun executing some projects, aiming to participate in projects at every stage of the offshore wind power value chain.

Fig. 1 Three scenarios and possible business impacts

Fig. 2 Concrete examples of risks and opportunities

Fig. 3 Factors affecting profit/loss from now to 2050 (1.5°C scenario, unit: JPY 100 million)

Fig. 4 Examples of measures to address physical risks