Footnote

(Note 1) Designed to further strengthen the Group's management system. 10 Group CxOs have been appointed, including the President of Sumitomo Mitsui Financial Group, Inc. who is the Group CEO.

(Corporate Governance - Executive Management Structure:https://www.smfg.co.jp/company/organization/governance/)

(Note 2) In Japan, the estimated depth of immersion is calculated based on the hazard map released by the Ministry of Land, Infrastructure, Transport and Tourism. For overseas, the estimated depth of immersion for each business corporation is calculated based on the AI analysis of Jupiter Intelligence. Jupiter Intelligence is a U.S. start-up company that analyzes climate change risk by collecting various data including satellite data and using AI analysis to predict the occurrence of natural disasters.

(Note 3) Data based on the following papers are used.

“Hirabayashi Y, Mahendran R, Koirala S, Konoshima L, Yamazaki D, Watanabe S, Kim H and Kanae S (2013) Global flood risk under climate change. Nat Clim Chang., 3(9), 816-821. doi:10.1038/nclimate1911.

(Note 4) A scenario that assumes that governments will continue with their current climate change measures, but will not strengthen them further.

(Sumitomo Mitsui Financial Group TCFD Report 2021 :https://www.smfg.co.jp/sustainability/materiality/environment/climate/pdf/tcfd_report_j_2021.pdf)

Quantitative Risk Measurements of Water-related Disasters

Sumitomo Mitsui Financial Group, Inc.

| Publication date | December 22, 2021 (Posted on May 25, 2022) |

|---|---|

| Sector | Industrial and economic activities |

Company Overview

Sumitomo Mitsui Financial Group, Inc. is the holding company of the SMBC Group, which is a "multifunctional financial group" that operates a wide range of businesses including banking, leasing, securities, credit cards, and consumer finance. Four business units have been established to draft and implement cross-group business strategies for each customer segment. For head office functions, we clarified who is responsible for the group-wide planning and management with the CxO system, enabling them to share management resources and optimize the allocation of resources.

Climate Change Impacts

In recent years, natural disasters such as typhoons and floods caused by climate change have been occurring frequently in Japan, and there are raising concerns about the risk that will affect the businesses of our customers. There are also expected risks of the decline in the value of assets (possibly becoming stranded assets) in the process of transitioning to a decarbonized society.

Adaptation Initiatives

In 2017, we announced our endorsement of the TCFD, and in 2019, became the first global financial institution to disclose the impact of physical risk based on climate change scenario analysis. In 2020, we published a TCFD report, including the results of the analysis of transition risks.

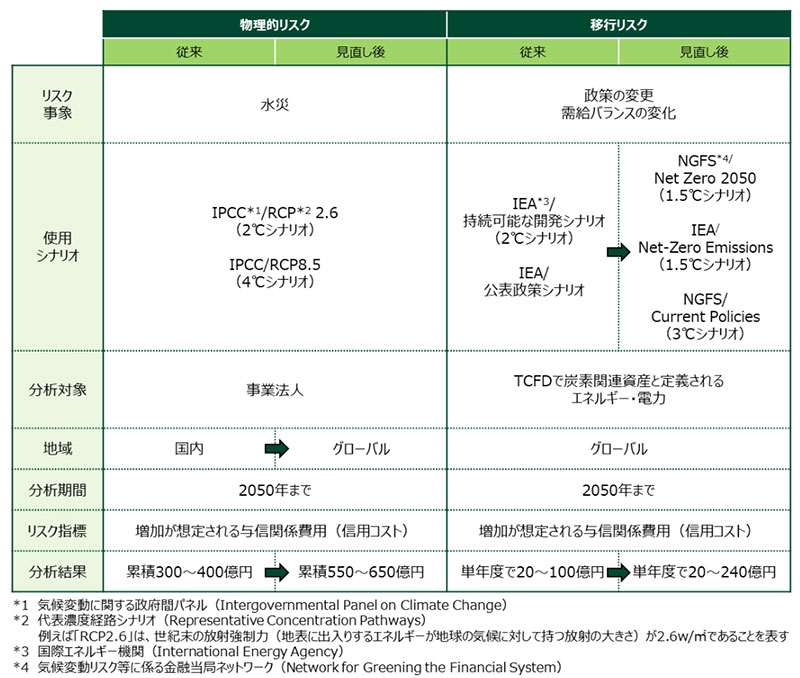

In FY2021, we expanded the target geography of our analysis of physical risks from domestic to global, and for transition risks, we analyzed a scenario in which the temperature increase from pre-industrial levels is expected to be less than 1.5°C by 2100 (1.5°C scenario), assuming that carbon neutrality is realized by 2050 (Figure 1). The content and results of the analysis are described below.

| Contents | Result | |

|---|---|---|

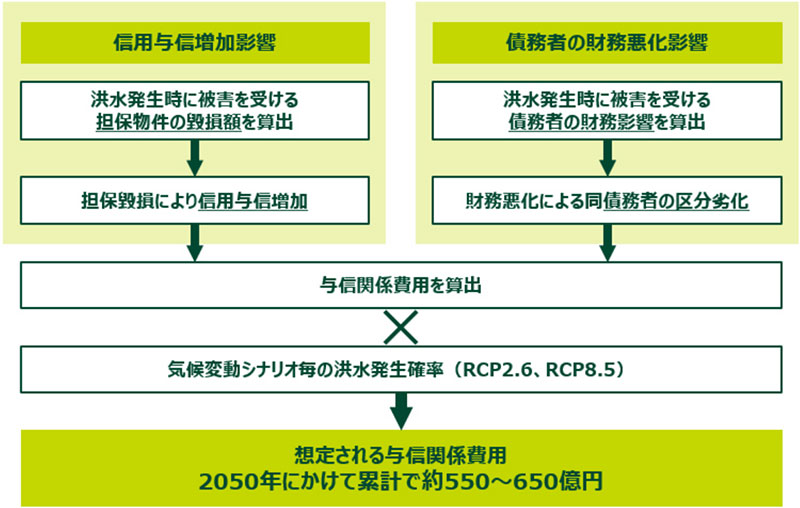

| Physical Risk | Based on the estimated depth of immersion within and outside of Japan (*2) and considering the probability of flooding (*3) for each climate change scenario (Figure 1), we calculated the estimated credit costs anticipated in the occurrence of a water disaster by 2050 (Figure 2), taking into account the impact on collateral damage and financial conditions of our customers. | Anticipated credit-related costs by 2050 were approximately 55-65 billion yen (JPY 30 to 40 billion in Japan), and in per-year average value terms, this will result in additional credit costs of approximately JYP 2 billion. The impact of water disasters caused by climate change on SMBC's current single-year finances is limited. |

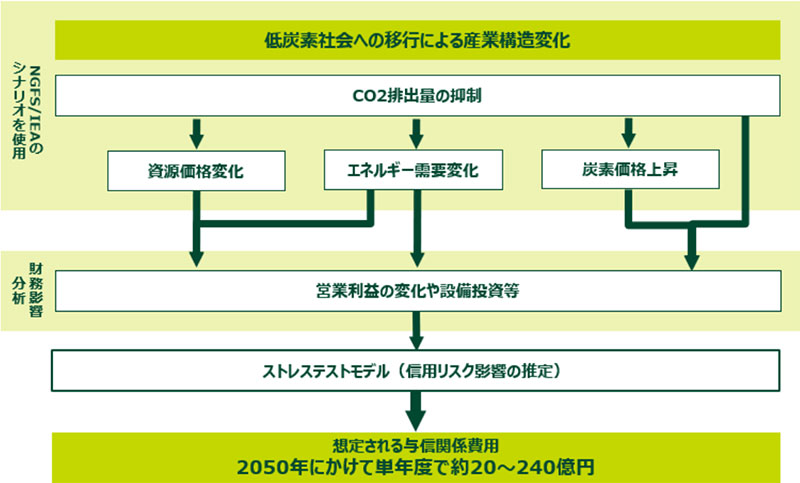

| Transition Risk | We analyzed the impacts of carbon price (such as crude oil and natural gas), resource prices, and changes in supply/demand (depending on the degree of GHG emission controls), on our performance of the energy and power sectors for each scenario (Figure 1). The results were reflected in a stress test model which estimates the impact of credit risk, and we calculated the anticipated credit costs by 2050 (Figure 3). | Under the 1.5°C scenario, we expected an increase in credit costs by approximately JPY 2 to 24 billion per fiscal year until 2050, vs. the Current Policies scenario/NGFS. The difference in the expected carbon price by 2050 in each scenario is one of the factors causing the range of the estimated values. |

Effects / Expected Benefits

We are strengthening our management of climate change risks by quantitatively assessing possible future risks through scenario analysis and discussing countermeasures at the management level. We will continue to expand the number of sectors subject to analysis and refine our analysis methods, utilize the methods and results of scenario analysis in our engagement with the stakeholders, and support our customers' smooth transition to a decarbonized society.

Fig. 1 Overview of scenario analysis

Fig. 2 Process of the analysis for physical risks

Fig. 3 Process of the analysis for transition risks