Disclosure in line with TCFD Recommendations

SUMITOMO LIFE INSURANCE COMPANY

Industry: Finance and insurance

| Publication date | October 11, 2023 (Posted on May 15, 2024) |

|---|---|

| Sector | Industrial and economic activities |

Company Overview

Since its establishment in 1907, Sumitomo Life Insurance Company has served its role in supporting the lives of numerous customers and their families through its life insurance business. In order to meet the diversifying needs of today, the company is promoting various initiatives, including the use of digital technology, development of consulting services, and support for customers to "enhance their health" and reduce risks. We aim to be a company that contributes to the "well-being" of its customers and society.

Climate Change Impacts

Among climate-related risks, the main risks that could have a significant impact on our business are the risk of incurring losses amid changes in the incidence of death, etc. over the medium to long term due to factors including higher average temperatures, and the risk of future impairment on the value of our investment assets under a situation where become subject to substantial effects involving our investees due to factors that include policy changes and regulatory reforms regarding the transition to a carbon-neutral society.

Adaptation Initiatives

Based on the awareness of climate-related risks, scenario analysis is required to evaluate effects of climate-related risks on the life insurance business and asset management business. In March 2019, we announced our endorsement of the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and performed scenario analysis enlisting following four steps in order to properly recognize the opportunities and risks that climate change poses to our business activities and to implement risk management and gain opportunities.

- STEP 1: Assess materiality of risks (physical and transition risks)

- STEP 2: Identify scenarios (*note 1)

- STEP 3: Evaluate business impacts (for life insurance and asset management business)

- STEP 4: Identify potential responses

The following results were obtained from this analysis for claims payment and asset management.

・Payments of insurance claims, etc.

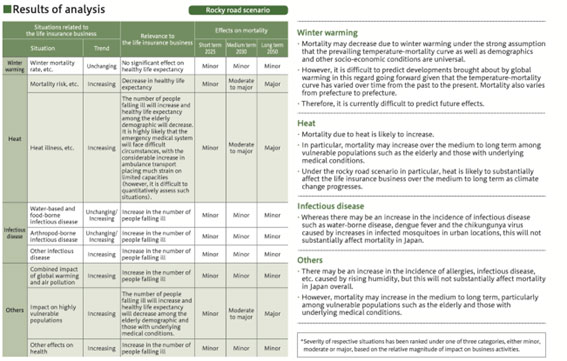

Scenario involving an increase in average temperature of 4°C delivers the most significant effect on the life insurance business. Evaluation findings indicate that heat would have a particularly substantial effect on the life insurance business, especially in terms of the scenario culminating in rising mortality over the medium to long term among vulnerable populations such as the elderly and those with underlying medical conditions. However, we anticipate this scenario would not substantially affect profit from insurance products. This is because we regularly revise expected mortality rates used in calculating rates of premium with respect to life insurance products, meaning that insurance premiums would reflect the impact of a situation where chronic change in mortality rate due to climate change occurs (Fig. 1).

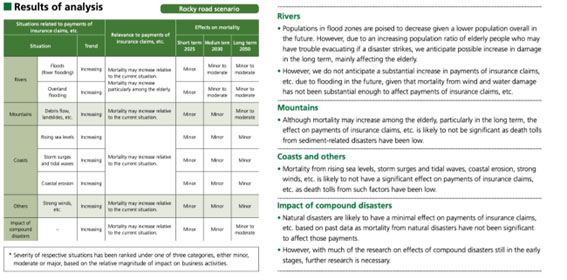

Regarding the analysis of the impact of natural disasters, the impact could have a particularly substantial effect on rivers, culminating in increased damage in the long term, mainly affecting the elderly. However, mortality from natural disasters has not been substantial enough to affect payment of insurance claims, etc. and even if climate change intensifies, we do not expect it to significantly affect profit from insurance products due to various disaster countermeasures, the likelihood of prior evacuation, and the growing public awareness and other factors (Fig. 2).

・Asset Management

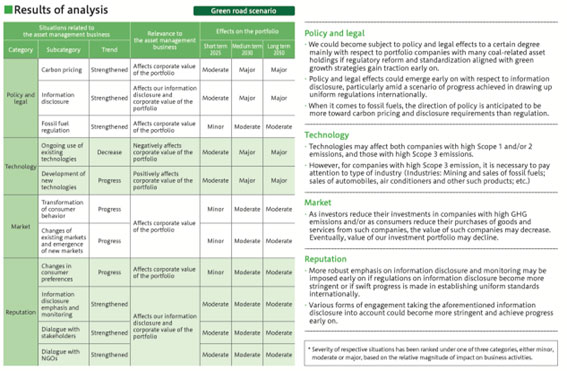

The largest impact is expected in the scenario involving an increase in average temperature limited to 2°C, especially in terms of government policies and legal regulations (carbon pricing and information disclosure) and technology (ongoing use of existing technologies and development of new one). The results indicated that certain risk events may moderately affect the asset management business even in the short term (2025) (Fig. 3).

Effects / Expected Benefits

The COP 26 United Nations Climate Change Conference in 2021 led to a commitment to pursue efforts for limiting the average temperature increase to 1.5℃ worldwide, making it the global standard. Accordingly, we will consider options for applying the 1.5°C scenario to our scenario analysis.

For our future responses, we will continue to study methods for quantitative analysis of the impact of the increase in mortality on payments of insurance claims and benefits, and investigate changes among regulatory authorities in other countries and consider necessary countermeasures.

Footnote

(Note 1) Selected scenarios with average temperature increases by 2°C (RCP 2.6) and 4°C (RCP 8.6) by 2100 compared to pre-industrial times.