Footnote

(Note 1) The TCFD Consortium was established on May 27, 2027 by five founders, including Professor Kunio Ito of Hitotsubashi University, as a forum to discuss effective corporate information disclosure and initiatives to link disclosed information to appropriate investment decisions by financial institutions and others. The Ministry of Economy, Trade and Industry, Financial Services Agency, and the Ministry of the Environment participated in the Consortium as observers.

(Note 2) IPCC stands for Intergovernmental Panel on Climate Change, an intergovernmental organization of international experts that collects and organizes scientific research on Global Warming.

(Note 3) IEA stands for International Energy Agency.

(Note 4) WRI stands for the World Resources Institute.

(Note 5) Water risk refers to water stress, drought, and flood risk, which indicate a deterioration in the supply-and-demand balance of water.

(Note 6) KPI stands for Key Performance Indicator.

Scenario Analysis Based on TCFD Framework (FY2021)

*This scenario analysis will focus primarily on the impact from physical risks.

Meiji Holdings Co., Ltd.

| Publication date | August 24, 2022 (Posted on June 14, 2023) |

|---|---|

| Sector | Industrial and economic activities |

Company Overview

Meiji Holdings Co., Ltd. is a pure holding company that owns Meiji Corporation, Meiji Seika Pharma Co., Ltd., and KM Biologics Co., Ltd., and is engaged in the management and operation of the group companies that manufacture and sell products in the area of food and pharmaceuticals.

Climate Change Impacts

The business of the Meiji Group is based on the abundant gifts of nature. We therefore believe that it is our responsibility to live in harmony with the global environment and nature. In recent years, however, the sustainability of the global environment has been in jeopardy. We recognize that climate change will have a significant medium- to long-term impact on our business activities and is an important management issue for the Group. International frameworks such as the Paris Agreement and the Sustainable Development Goals (SDGs) are also calling for increased efforts to address climate change. To contribute to these international efforts, we are implementing climate change initiatives to help achieve a decarbonized society.

Adaptation Initiatives

In 2019, the Meiji Group agreed to join the Task Force on Climate-Related Financial Disclosures (TCFD) and the TCFD Consortium (Note 1), and we started our analyses and disclosures based on the TCFD framework. We outline our TCFD initiatives below.

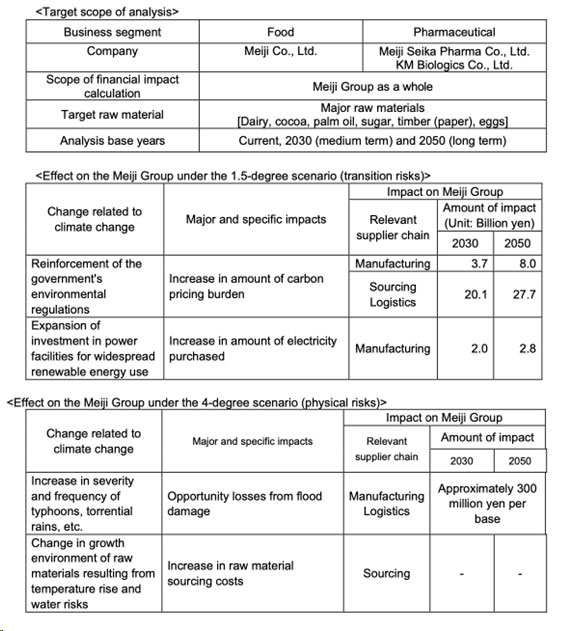

●Scenario analysis for the Meiji Group as a whole

We established three scenarios (1.5°C scenario, 2°C scenario, and 4°C scenario) based on information from the IPCC (Note 2) and IEA (Note 3), and set 2030 (mid-term), and 2050 (long-term) as the base years. We analyzed the risks and opportunities of climate change in the mid- and long-term and examined the countermeasures. Figure 1 shows the major impacts under the 1.5°C and 4°C scenarios from the results of our analysis and the results for the 4°C scenario (physical risk) that involves major impact are as follows.

[Opportunity losses such as site shutdowns resulting from flood damage]

The estimated amount of damage per flood is on the scale of 300 million yen, based on previous cases. We calculated this amount by referencing the damage (e.g., unsaleable products discarded as a result of distribution network disruption) the Meiji Group incurred as a result of floods caused by heavy rainfall. Twelve of our bases are expected to face opportunity losses from floods, taking into consideration results achieved by using Aqueduct, am open-source tools for global water risk evaluation by WRI (Note 4), and the availability of alternative production bases.

[Impact on sourcing of major raw materials]

We expect climate change-based temperature rise and water risks to reduce crop yields and shift the unit prices of raw materials in raw material production areas. Below, we overview the results of our analysis on water risks (Note 5) and changes in yields at raw material production areas.

| Expected changes in yields |

|

|---|---|

| Expected water risks |

|

Effects / Expected Benefits

We will identify the circumstances of high-risk bases by collaborating with them and analyzing gaps between risk evaluation results, and based on those results, take proper flood risk countermeasures upon factoring in the Business Continuity Plan. Countermeasures have already been taken at the Odawara Plant of Meiji Seika Pharma Co., Ltd. (e.g., introducing provisional water stops, installing new waterproof banks at its transformer substation, and introducing backup boards for outdoor air conditioner units).

We also expect the sourcing costs for major raw materials to increase, and we will endeavor to reduce these costs through the following initiatives.

| Product-related measures |

|

|---|---|

| Raw material-related measures |

|

| Production- and distribution-related measures |

|

| Collaboration with Suppliers |

|

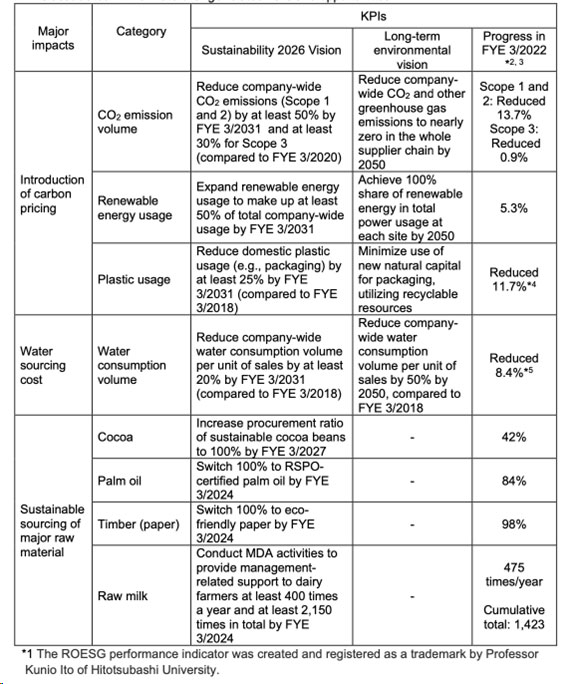

The Meiji Group established materiality and KPIs (Note 6) by formulating the Meiji Group Sustainability 2026 Vision and our long-term environmental vision, the Meiji Green Engagement for 2050. Given that responses for climate change-related risks and opportunities (e.g., activities to reduce environmental impacts and raw material sourcing) entail diverse action, we have established the following KPIs and manage their progress accordingly (Fig. 2).

Fig. 1 Major impacts and specific effects on the Meiji Group under the 1.5°C and 4°C scenarios

Fig. 2 KPIs associated with climate change-related risks and opportunities