Footnote

(Note 1) A tool to quantitatively evaluate changes in typhoon frequency, force, storm surge, etc., based on the RCP scenarios of the Intergovernmental Panel on Climate Change (IPCC).

(Note 2) Fire, marine, personal accident, auto line, etc.

(Note 3) Scenario in which the global average temperature in 2081-2100 increases by 2.6-4.8°C (average of 3.7°C) compared to the temperature in 1986-2005, and in 2046-2065, the average will increase by 2.0°C.

(Note 4) Scenario in which the global average temperature in 2081-2100 increases by 1.1-2.6°C (average of 1.8°C) compared to the temperature in 1986-2005, and in 2046-2065, the average will increase by 1.4°C.

(Note 5) Real-Time Damage Prediction Website -cmap

Aioi Nissay Dowa Insurance Co., Ltd.(https://www.aioinissaydowa.co.jp/corporate/service/cmap/)

Examples of Adaptation Business on APLAT by the National Institute for Environmental Studies

Aioi Nissay Dowa Insurance Co., Ltd.(https://adaptationplatform.nies.go.jp/private_sector/database/opportunities/report_077.html)

Scenario Analysis and Climate Change Adaptation Efforts In Line with TCFD Recommendations

MS&AD Insurance Group Holdings, Inc.

| Publication date | September 21, 2022 (Posted on May 9, 2024) |

|---|---|

| Sector | Industrial and economic activities |

Company Overview

MS&AD Insurance Group Holdings, Inc. is the holding company of an insurance and financial group with Mitsui Sumitomo Insurance Company Co.,Ltd. and Aioi Nissay Dowa Insurance Co., Ltd. With the domestic non-life insurance business as our core business, we operate domestic life insurance business, financial services business, overseas business, and risk-related services business, by rapidly and significantly improving quality and expanding our operating presence and corporate resources.

Climate Change Impacts

The global average temperature in 2020 is about 1.2°C higher than the pre-industrial average, and if initiatives to mitigate the progression of global warming are not taken, the average temperature in 2100 could rise by more than 4°C compared to the pre-industrial era. As global warming progresses, natural catastrophe tends to become more severe, and the insurance payment for natural catastrophe may increase significantly.

Adaptation Initiatives

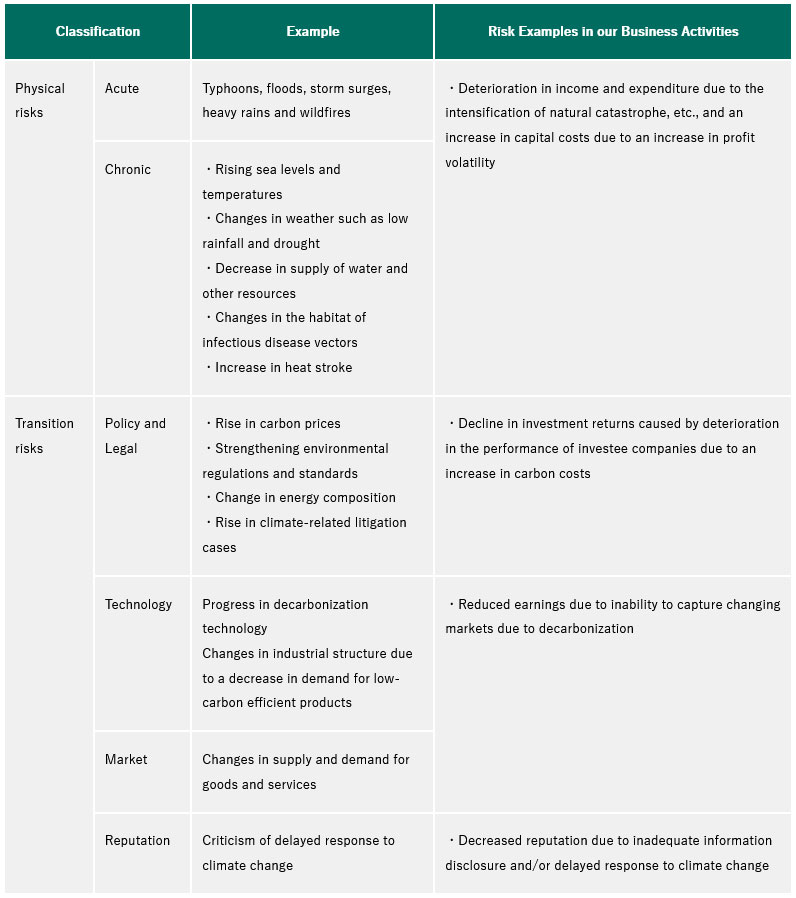

Recognizing the significant impact of climate change, we endorsed the idea of the Task Force on Climate-related Financial Disclosures (TCFD) in December 2017. Subsequently, we have been disclosing information in line with the TCFD recommendations, and in August 2021, we published our climate-related financial information in the TCFD Report. In this disclosure, climate change risks are classified into physical risks and transition risks (Fig. 1).

For physical risks, we used an assessment tool (Note 1) developed through a project of the United Nations Environment Programme Finance Initiative, in which over 20 insurance companies that signed on to the Principles for Sustainable Insurance (PSI), including our company, participated. For domestic non-life insurance book (Note 2), we examined the impact of typhoons on insurance underwriting considering the changes in force and other factors that would change with the progression of global warming. We confirmed the possibility of an increase in insurance payouts due to changes in the following two points.

●Changes in the typhoons themselves

In 2050 under the 4 °C scenario (RCP 8.5) (Note3), insurance loss arising from typhoons could vary from approximately + 5% to approximately + 50% due to changes in "intensity," and from approximately − 30% to approximately + 28% due to changes in "frequency of occurrence."

●Changes in storm surge caused by typhoons

In both the 2 °C (RCP 4.5) (Note 4) and 4 °C (RCP 8.5) scenarios in 2030 and 2050, insurance loss may increase by several percent.

We will continue to examine methods for assessing the impact of climate change such as typhoons and floods, while referring to the analysis methods based on United Nations Environmental Plan Finance Initiative projects. Taking into account the impact of climate change, we will continue to control the retention of risk amount and secure the capital necessary to maintain our financial soundness.

We have also been promoting climate change adaptation by providing services to help eliminate or reduce damage and loss caused by natural disasters.

In the event of a natural disaster, we establish an efficient payment procedure that uses AI and drones to conduct damage investigations so that our clients can recover promptly by our insurance claims payment. We also started providing “cmap.dev (Note 5)”, a website that forecasts the number of damaged buildings and the damage ratio for each municipality and displays the real-time forecast outcomes on a map, which is available to the general public to prevent the spread of damage.

Effects / Expected Benefits

Taking into account the effects of climate change, we will continue to create shared value with the society by controlling the retention of risk amount to ensure financial soundness and by providing products and services that will help the society move forward with climate change mitigation and adaptation.

Fig. 1 Classification of climate-related risks