Disclosure of Financial Impact Based on Scenario Analysis

MARUI GROUP CO., LTD.

| Publication date | October 11, 2022 (Posted on April 24, 2023) |

|---|---|

| Sector | Industrial and economic activities |

Company Overview

MARUI GROUP CO., LTD. is engaged in business planning and management of our group companies engaged in retail and fintech businesses. Since our founding in 1931, we have continued to innovate and evolve our unique business model which merges retailing and finance in line with changes in the times and the needs of customers. We have been acting in accordance with our founding spirit of “co-creation of credibility" and "innovation and evolution" that we have cultivated by working together with and being empathetic toward customers.

Climate Change Impacts

Recognizing that a 4°C rise in the global temperature resulting from climate change would have an enormous impact on society, and we believe it is important to work together to contribute to the movement seeking to limit global warming to below 1.5°C above pre-industrial levels. In order to strengthen our ability to respond to scenarios, we will identify the impact of climate-related risks and opportunities on our business, and proceed to formulate relevant strategies.

Adaptation Initiatives

MARUI GROUP became the first Japanese retailer to endorse the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) in November 2018. We have been assessing the risks and opportunities that impacts our business and have been disclosing information through our Annual Securities Report and Co-Creation Management Reports, website, and communications with our key stakeholders.

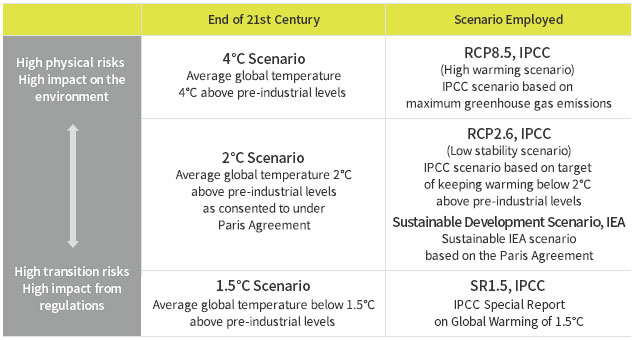

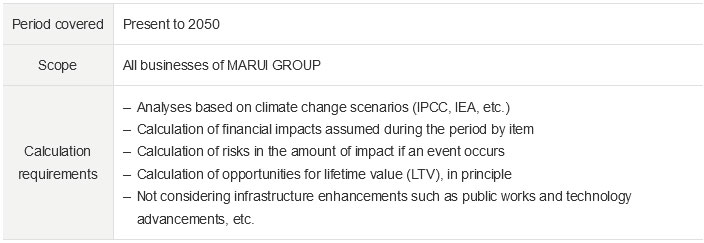

We performed scenario analysis based on three climate change scenarios developed by the Intergovernmental Panel on Climate Change (IPCC), the International Energy Agency (IEA), and other world expert organizations (Fig. 1). Under the assumptions (Fig. 2), we calculated the amount of impact on income anticipated within the period through 2050 for physical risk, transition risk, and opportunity (Fig. 3).

- ① The world with average temperatures 4°C above pre-industrial levels

- ② The world with average temperatures 2°C above pre-industrial levels based on the Paris Agreement

- ③ The world illustrated in the IPCC special report on the impacts of global warming of 1.5°C above pre-industrial levels.

As physical risks, we confirmed the impact on rent revenues due to the suspension of store operations, suspension of group-wide business operations due to building damage and system downtime from floodings by typhoons and torrential rains.

For transition risks, under scenario ③, we recognize that the impact will be stronger than physical risks. However, it can be expected that flood damage will be incurred as a result of sudden and severe typhoons and rains even if we are successful in limiting the rise in the global temperature to below 1.5°C above pre-industrial levels.

For opportunities, climate change is expected to stimulate increased environmental awareness and lifestyle changes among consumers, and this will create various opportunities for us to take part in sustainable initiatives. Furthermore, new opportunities will likely also arise to be capitalized on by responding to the change in the electricity market and government environmental policy stemming from the popularization of renewable energy.

Effects / Expected Benefits

The identified risks and opportunities are managed in terms of strategy formulation and individual business operations through our sustainability promotion system.

Going forward, strategies and measures will be examined based on external factors including climate change and other trends in the world that may impact corporate strategies as well as legal and regulatory revisions, and internal factors including progress in the measures of Group companies and future risks and opportunities.

Fig. 1 Analysis of three scenarios and projected risks

Fig. 2 Assumptions

Fig. 3 Risks and opportunities associated with climate change