Footnotes

(Note 1) Hazard maps released by the Ministry of Land, Infrastructure, Transport and Tourism: Flooding risk area map based on estimated maximum rainfall

(Note 2) Jupiter Intelligence, Inc.: U.S. startup company specializing in climate change risk analysis that collects a variety of data, including satellite data, and uses AI analysis to predict the occurrence of natural disasters.

(Note 3) Large-scale Assessment of Flood Risk Due to Climate Change: Conducted by MS&AD InterRisk Research & Consulting in collaboration with the University of Tokyo and Shibaura Institute of Technology (Hirabayashi Y, Mahendran R, Koirala S, Konoshima L, Yamazaki D.) Watanabe S, Kim H and Kanae S (2013) Global flood risk under climate change. Nat Clim Chang., 3(9), 816-821. doi:10.1038/nclimate1911.)

(Note 4) IPCC: Intergovernmental Panel on Climate Change

Advancement of Climate Change Scenario Analysis Using AI Technology

Sumitomo Mitsui Financial Group, Inc.

| Publication date | December 14, 2021 (Posted on May 25, 2022) |

|---|---|

| Sector | Natural Disasters / Coastal Areas, Industrial and economic activities |

Company Overview

Sumitomo Mitsui Financial Group, Inc. (SMBC Group) is a global financial group that operates a wide range of businesses including banking, leasing, securities, credit cards, and consumer finance. Under the holding company, Sumitomo Mitsui Financial Group, four business units have been established to draft and implement cross-group business strategies for each customer segment. For head office functions, we clarified who is responsible for the group-wide planning and management with the CxO system, enabling them to share management resources and optimize the allocation of resources.

Climate Change Impacts

Since the Japanese government announced a net-zero emissions goal for 2050 in October 2020, a 46% reduction target for greenhouse gases was set for 2030 in April 2021 and initiatives for sustainability, including the transition to a decarbonized society, have been accelerating. It is expected that customer needs for sustainability, including decarbonization, will become more diverse and advanced in the future. There is also a risk that the business of our customers will be affected by an increase in extreme weather due to climate change.

Adaptation Initiatives

As part of our response to the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), a framework for disclosing information on climate change, the SMBC Group has upgraded its climate change scenario analysis of physical risks using AI technology. This is an attempt to solve the problems of climate change scenario analysis, such as lack of scientific data and lack of comprehensiveness of target areas. By analyzing various climate related data and satellite images of landforms through AI-based machine learning, the risk of water disasters can be quantitatively determined.

The analysis were conducted in the following three steps (Figure 1).

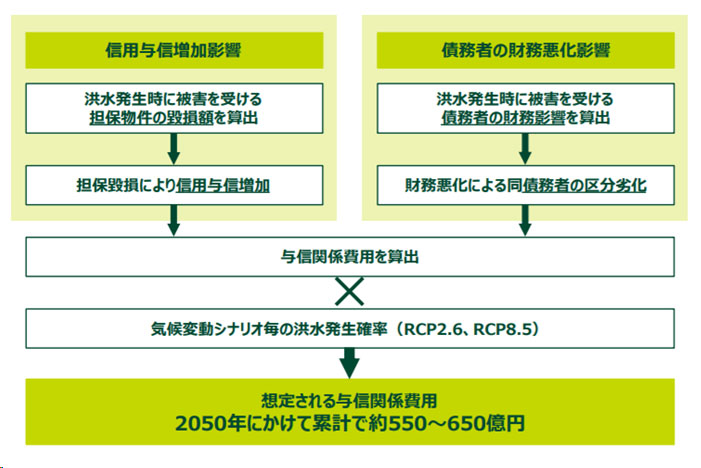

Step 1: Regarding the impact of flood disasters on business performance, we estimated that the credit-related costs are expected to rise through two routes: damage to the collateral value of SMBC's corporate customers, and degrading of the debtor classification due to the deterioration in financial conditions. For Japan, we used the hazard map released by the Ministry of Land, Infrastructure, Transport and Tourism (*1) to determine the estimated immersion depth for each collateral and corporate customer located on the map. For overseas, we used the AI analysis of Jupiter Intelligence (*2) to calculate the estimated immersion depth for each corporate customer. Based on these immersion depths, we analyzed the impact of collateral damage and financial deterioration (Figure 2).

Step 2: Using the data provided by the Large-scale Assessment of Flood Risk Due to Climate Change (*3), we set the probability of flooding up to 2050 in each of the 2°C scenario and 4°C scenario based on the IPCC (*4) research.

Step 3: Estimated credit costs are calculated by taking into account the credit-related costs estimated in Step 1 and the probability of flooding for each climate change scenario set in Step 2.

As a result of this analysis, the anticipated credit-related costs were approximately 55 to 65 billion yen (30 to 40 billion yen within Japan) in total by 2050. This represents an additional credit cost of about 2 billion yen in per-year average value. Therefore, the impact of water disasters caused by climate change on SMBC’s current single-year finances is expected to be limited.

Effects / Expected Benefits

By using AI technology, it has become possible to predict the immersion depth expected in the occurrence of water disasters (flooding) in any part of the world. As a result, it has become possible to quantitatively understand the risk of flooding even in areas where there are no hazard maps published by public organizations, and we have been able to add overseas corporate customers to the subject of analysis.